As your trusted real estate agent in Las Vegas and Henderson, it’s my job to stay up-to-date on market trends and analyst predictions. Currently, the industry’s gaze is fixed firmly on the future, specifically, the outlook for the housing market in 2025.

In the United States, the housing market traditionally moves through a peak season, when home prices inevitably rise, followed by a softer season. For instance, as we venture into the middle of the year, the market is transitioning from a period of rising prices to a milder season. Despite potential modest drops in home prices in the latter half of 2024, primarily attributed to market softening in Gulf regions, analysts are united in their belief that national home prices will maintain their overall growth.

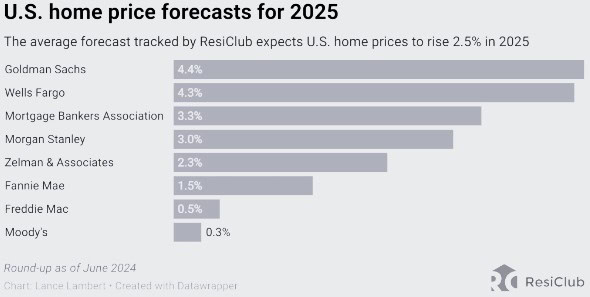

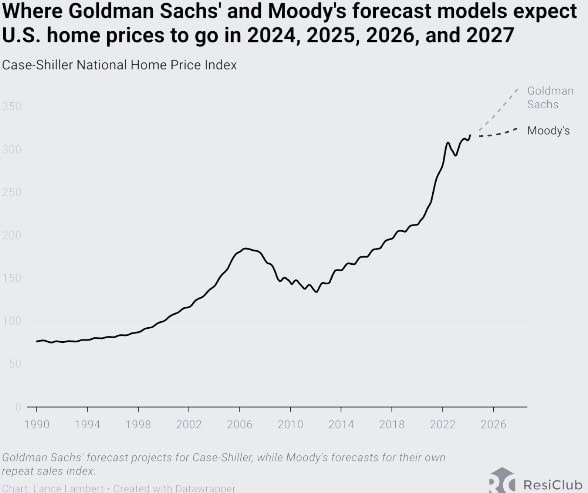

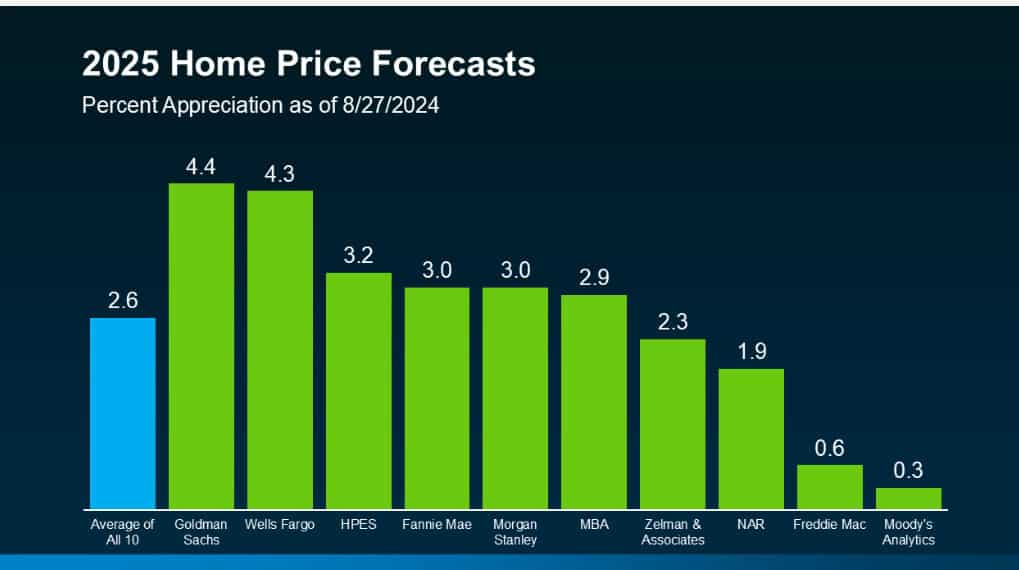

Extending the forecast into 2025, the consensus among experts varies. A renowned market tracker, ResiClub, reveals that the average forecast for home prices in 2025 sits at a modest 2.5% increase. The more optimistic prediction comes from Goldman Sachs, projecting a 4.4% rise, while Moody’s offers the most conservative estimate with a mere 0.3% increase.

Insights from Goldman Sachs and Moody’s are particularly interesting as they offer contrasting views on future trends. Goldman Sachs anticipates that home price growth will continue to stick close to its historical annual average of around 4.5%. Conversely, Moody’s expects a period of stagnant home prices, citing affordability impacted by the pandemic’s housing boom and related mortgage rate shocks as the main hurdle for growth.

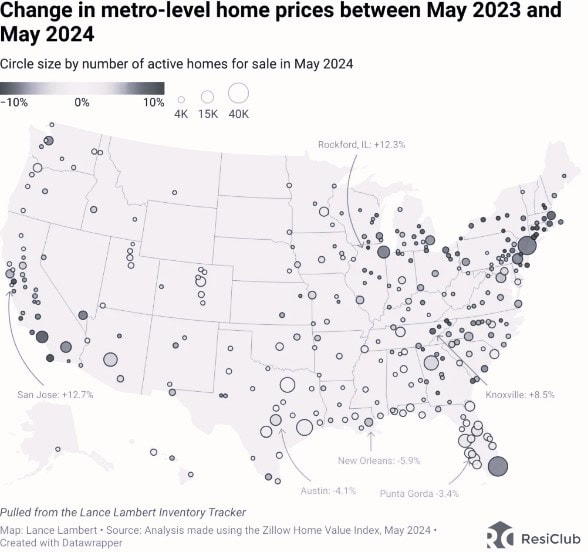

Looking at the regional level, some markets might experience minor price declines, while others continue to appreciate. Key factors that could influence these trends include the labor market, coupled with the active inventory and supply.

While all these forecasts present a national overview, the indices they refer to might vary. Goldman Sachs refers to the Case-Shiller National Home Price Index, Freddie Mac uses the Freddie Mac House Price Index, and Moody’s relies on its repeat sales index.

Source: fastcompany.com

Another Look

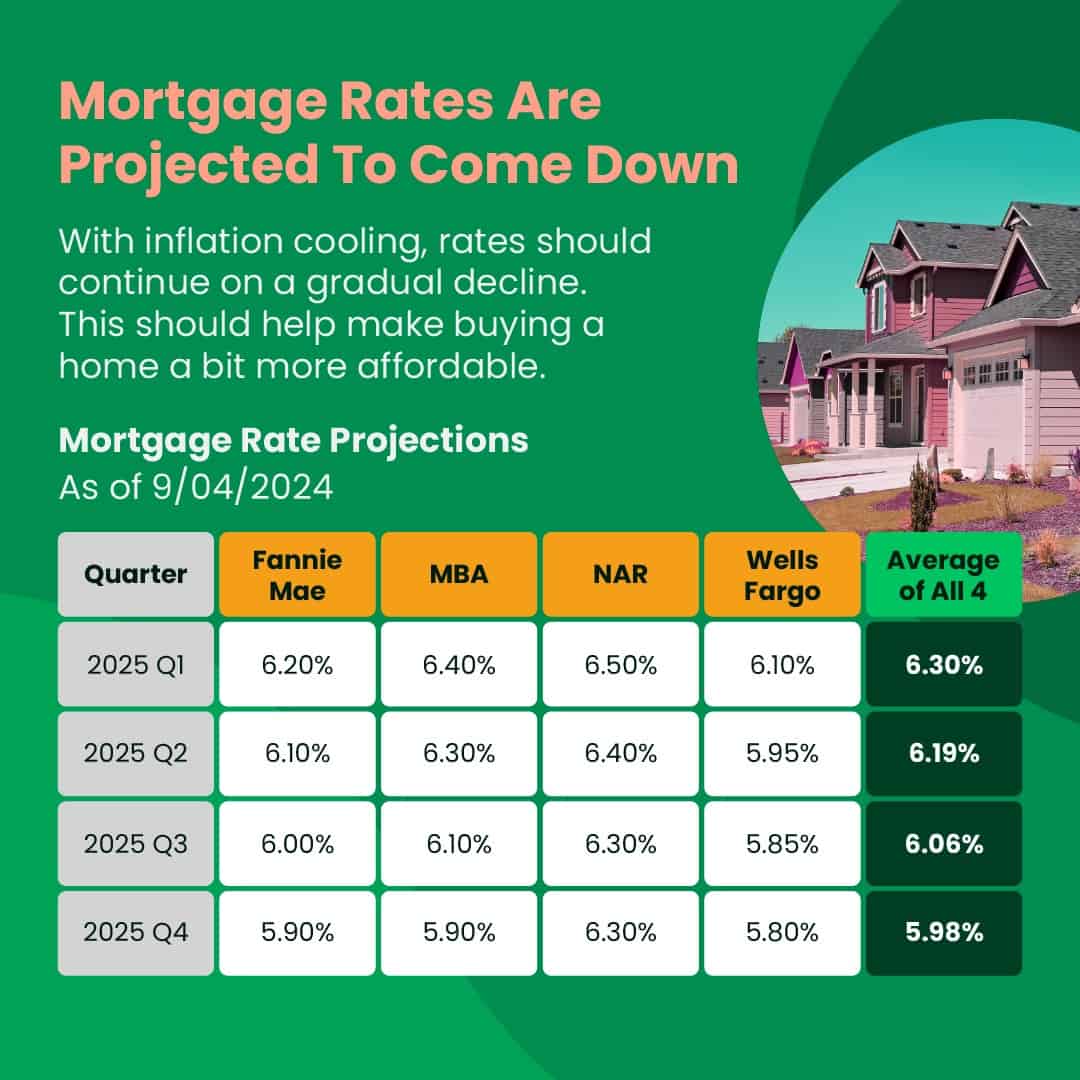

Predicted Dip in Mortgage Rates

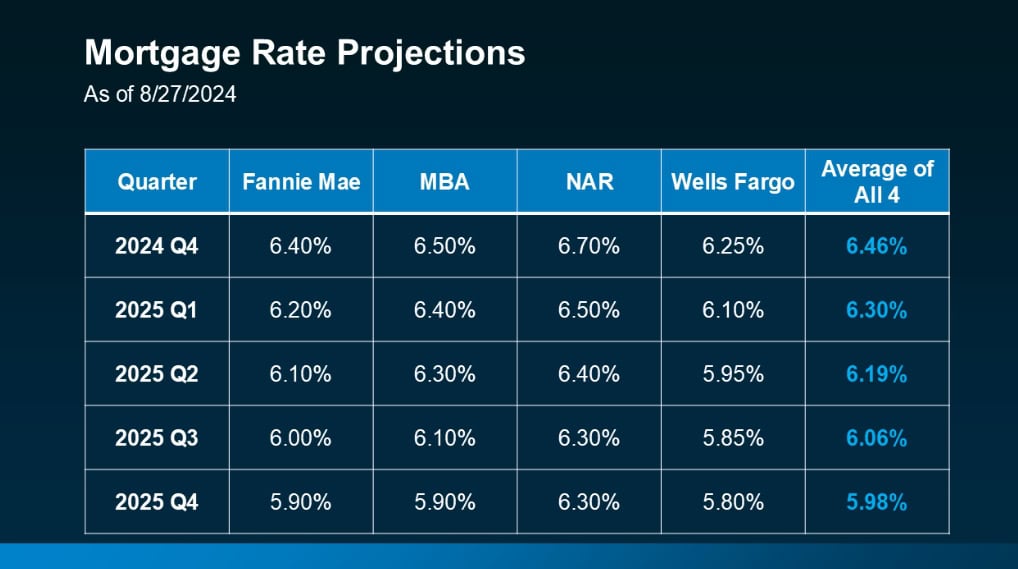

The influence of mortgage rates on the housing market is immeasurable. The 2025 projections from housing giants like Fannie Mae, the Mortgage Bankers Association (MBA), the National Association of Realtors (NAR), and Wells Fargo, hint at a marginal decrease in mortgage rates in the coming year (refer to the chart):

Mortgage rates are expected to reduce due to the calming down of inflation and a slight rise in joblessness rates, both indicators of a sturdy but decelerating economy. These signs are believed to promote a reduction in the Federal Funds Rate by the Federal Reserve, leading to lower mortgage rates. In the words of Morgan Stanley:

“Anticipating the U.S. Federal Reserve to initiate cutting its benchmark interest rate in 2024, there’s scope for mortgage rates to follow suit—at least marginally.”

The Housing Market Will See More Sales

The housing market will witness a surge in the number of available homes as well as an increased demand, as more buyers and sellers who were previously hesitant due to high rates decide to participate. This is a significant reason why a rise in home sales is predicted in the ensuing year.

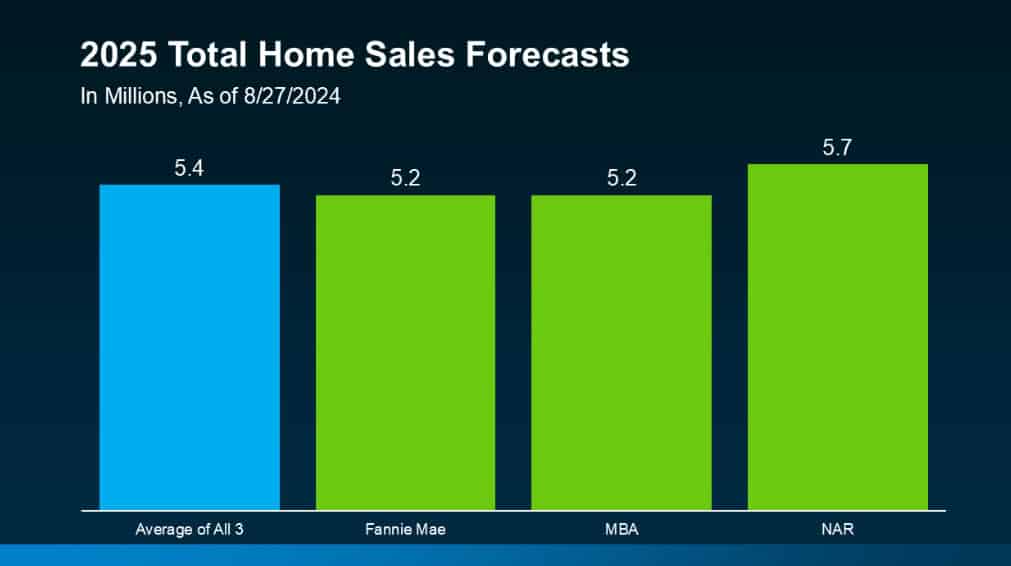

Renowned entities such as Fannie Mae, MBA, and NAR project that total home sales will experience a slight hike, with around 5.4 million homes predicted to be sold in 2025 (refer to the graph):

This represents a modest increase from the relatively lesser sales figures in 2023 and 2024. For context, approximately 4.8 million total homes were sold in 2023, and the projections for this year are around 4.5 million homes.

While the marginally lower mortgage rates may not usher a deluge of buyers and sellers back into the market, it will surely instigate more activity. This means a larger number of homes for sale – and a rise in competition among purchasers eager to secure them.

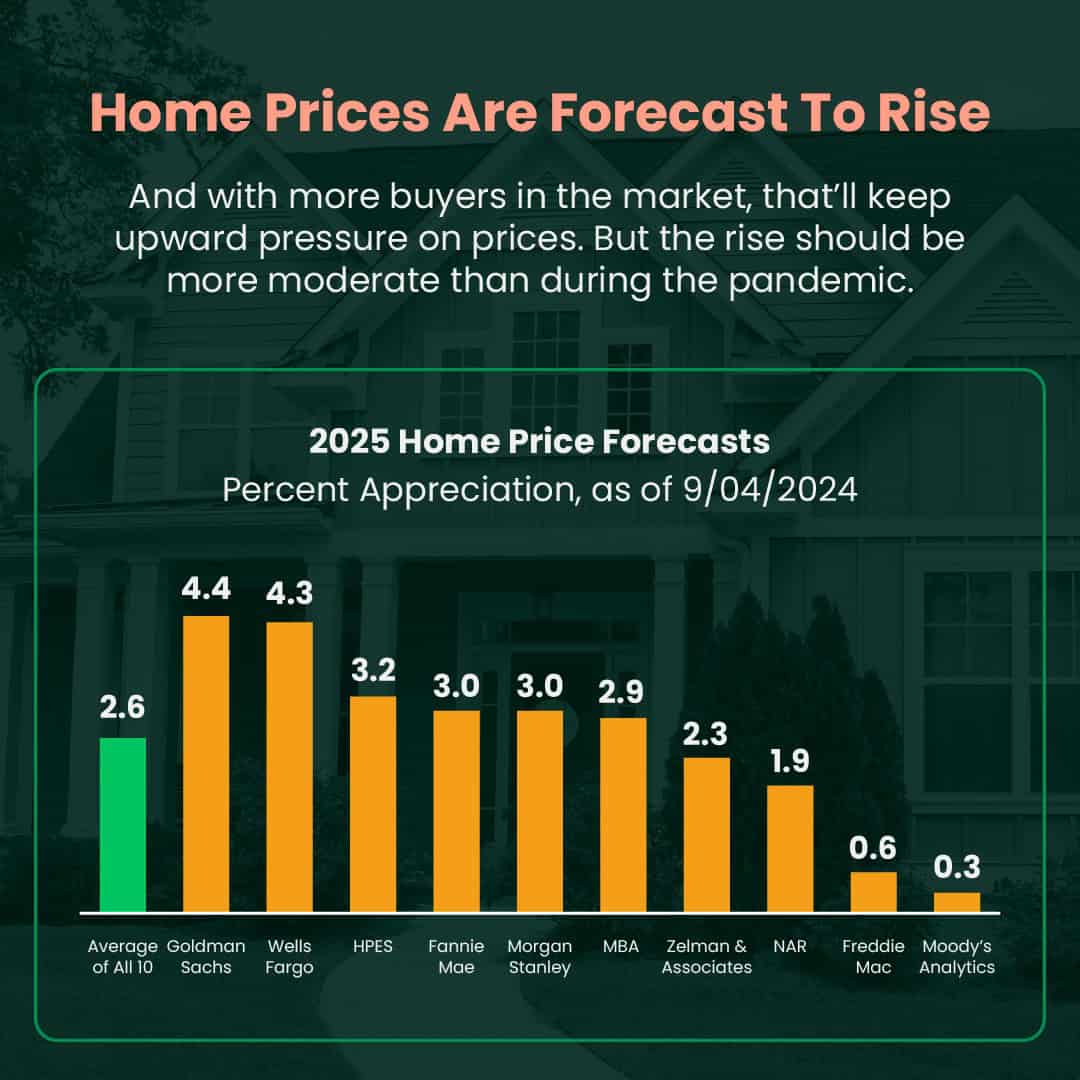

Moderate Rise in Home Prices

The increased readiness of buyers to jump into the market will keep pushing prices upward. Have a glance at the recent price predictions provided by 10 of the most reliable sources in the property market (refer to the following graph):

On average, property prices are expected to increase nationally by approximately 2.6% for the next year. Although predictions vary on the extent of this rise, it is undeniably agreed upon that prices will continue to surge moderately next year at a slower, more normal pace. It’s essential to remember that prices will always differ according to the local market.

Source: mykcm.com

Key Takeaways

Getting a grip on the 2025 housing market forecasts can aid you in planning your next move. Whether you’re contemplating buying or selling a house, staying updated about these trends will ensure you make the best decision within your means. Feel free to reach out and discuss how these forecasts could affect your plans.

Remember, these predictions are simply educated estimations and should not be regarded as an absolute guide to future market trends. As always, individual circumstances and local market conditions will greatly influence your real estate decisions. So, if you plan to buy or sell a property in Las Vegas or Henderson, count on me to provide you with the most reliable and up-to-date real estate information.