Are you feeling disheartened about the current state of the housing market? Hang in there. After a challenging period in 2022 & 2023, it appears that 2024 is presenting a more favorable landscape for prospective homebuyers.

To recap the unfavorable aspects of the housing market: Home prices experienced a significant surge from mid-2020 to mid-2022. Subsequently, mortgage rates escalated, reaching nearly 8% in October 2023 for the 30-year fixed-rate home loan. Affordability became a major hurdle for homebuyers as high interest rates diminished their borrowing capacity, & limited housing options further compounded the challenges.

Simultaneously, increasing rental costs made it challenging to accumulate a down payment or even secure an affordable rental property. The average annual rent for tenants rose by 6% in 2022 & another 8% in 2023, compared to an average increase of less than 4% per year in the preceding 14 years.

Despite the rough patch in recent years, there’s optimism for improvement in 2024 concerning mortgage rates, home prices, & the availability of both new & used homes for sale. While buying a home may still pose challenges in 2024, it might prove to be a less frustrating experience compared to the difficulties faced in 2022 & 2023. Let’s take a look at the facts.

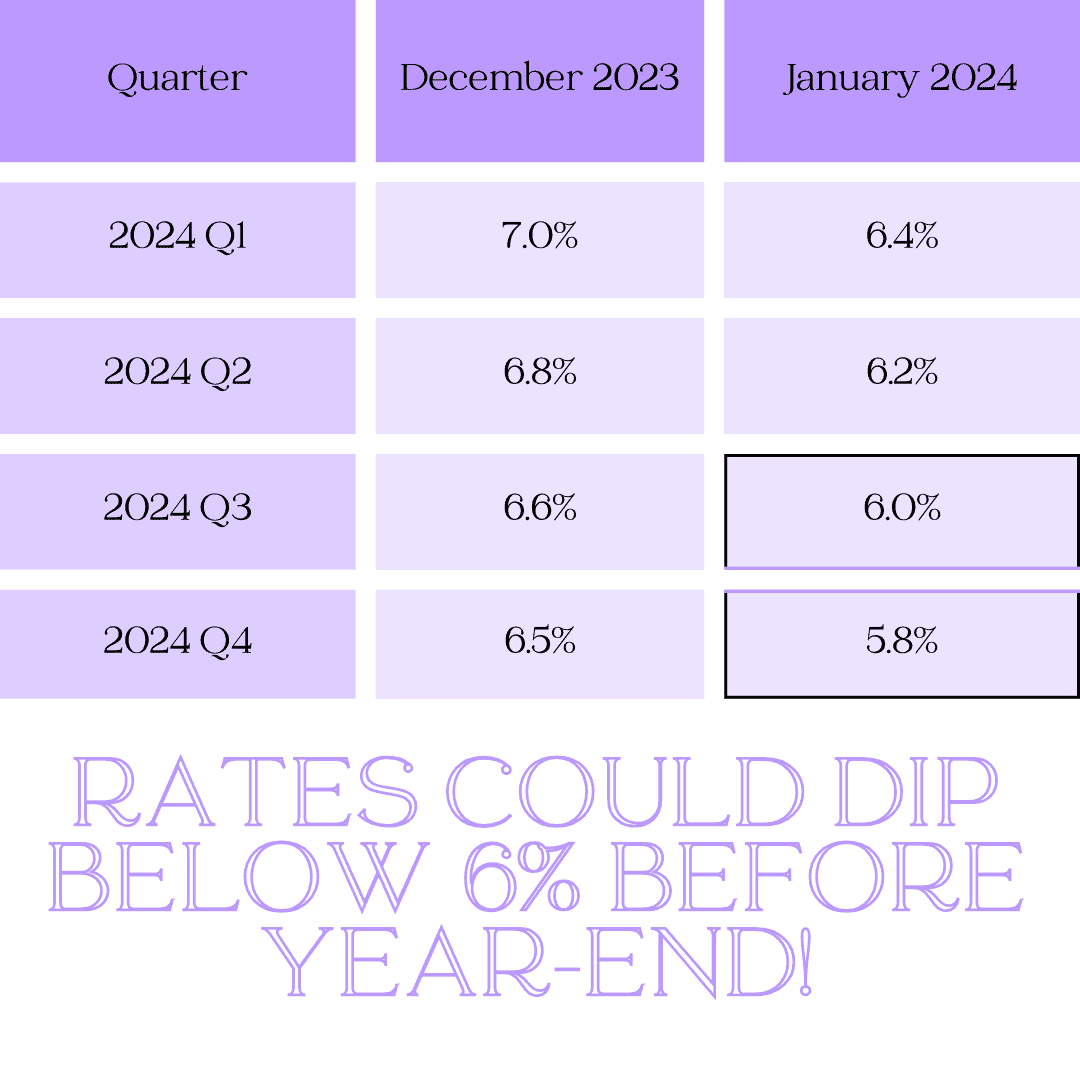

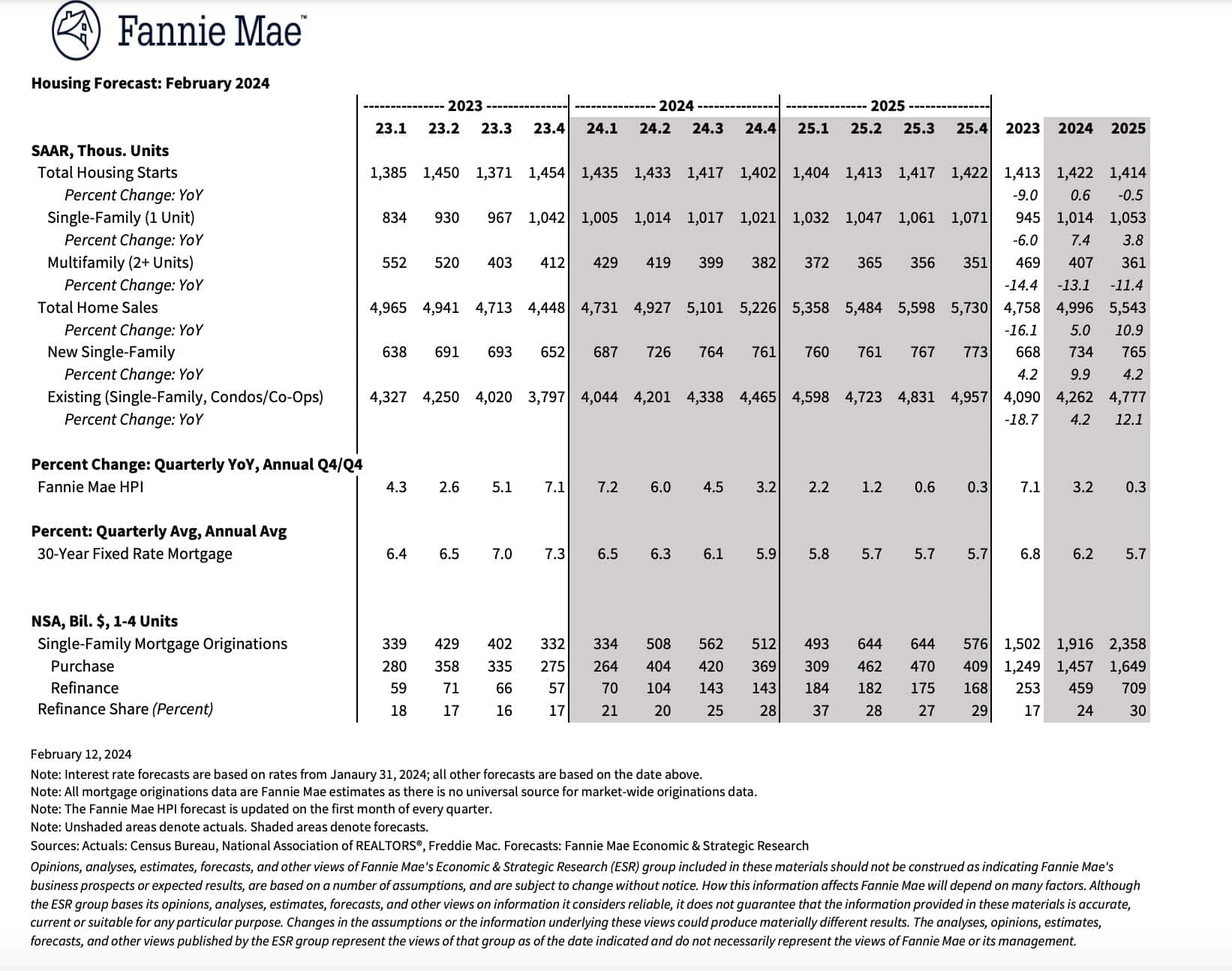

Mortgage Rates Should Keep Dropping

As a realtor, there’s encouraging news on the horizon regarding mortgage rates. The most significant development in recent months has been the positive trend in mortgage rates, marking an improvement since autumn. According to Freddie Mac’s weekly survey, the average rate on the 30-year fixed-rate mortgage dropped to 6.64% in January, down from October’s average of 7.62%.

This nearly one-percentage-point decrease has a substantial impact on affordability, potentially reducing the monthly payment on a $300,000 loan by $198. As inflation is expected to cool off, forecasters anticipate further declines in mortgage rates. Projections from Fannie Mae & the Mortgage Bankers Association suggest that the 30-year mortgage could average around 6% in the fourth quarter of 2024, a notable decrease from the 7.3% recorded at the end of 2023.

The evolving landscape suggests a favorable trajectory for both current & potential homebuyers.

Home Prices are Rising

It’s important to note that home prices are not expected to experience a decline in 2024, unlike the positive trend observed in mortgage rates. However, the pace of price growth is anticipated to slow down compared to the remarkable surge seen from August 2020 through June 2022, where prices rose by a staggering 33.3% in less than two years.

Already, there has been a deceleration in price increases. In December 2023, the National Association of Realtors reported that the median resale price of an existing home was $382,600, reflecting a modest 4.4% increase from the same month a year earlier. Despite this slowdown, the lingering impact of the accelerated prices over the preceding two years continues to pose challenges for home buyers.

President of Altos Research, Mike Simonsen expressed in a mid-January commentary, “Because the country is still faced with affordability challenges, it’s really hard to see any force that would push home prices dramatically higher this year.” This insight underscores the ongoing struggles that homebuyers face in the wake of the previous rapid price increases.

Homes Sell at Lower Price Points

There’s a crucial factor poised to temper the escalation of home prices: Home builders are actively contributing to the housing stock. In 2023 alone, they completed just over a million single-family houses & 450,000 multi-unit dwellings, ranging from duplexes to high-rise apartments.

Construction momentum remains robust, with 1.65 million housing units underway as we entered 2024. Builders are focusing on increasing the number of houses while reducing the construction of apartments. This vigorous pace benefits buyers by expanding the pool of available homes. By the close of 2022, there were a total of 1.42 million new & existing homes for sale. By the end of 2023, this figure had risen to 1.45 million.

In a positive shift, the U.S. Census Bureau notes that home builders are targeting lower price points. This change occurred swiftly, with 38% of newly constructed single-family houses priced under $400,000 in December 2022. By December 2023, this proportion had increased to 47%. It’s essential to highlight that this shift pertains specifically to single-family houses. This trend signifies a favorable direction for homebuyers seeking more affordable options in the housing market.

However, will sellers show up?

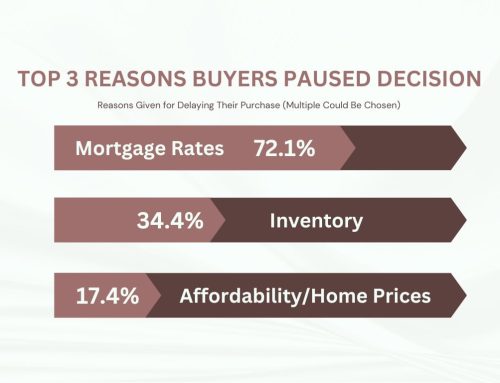

Combining these trends—decreasing interest rates, a moderation in house prices, & robust home construction—it becomes apparent to optimists that houses may become more affordable in 2024. The key question is: Will homeowners impede progress by holding back their homes from the resale market?

Data from the Urban Institute, reveals that almost half of homeowners with mortgages have home loans featuring rates of 3.5% or lower. Despite current mortgage rates exceeding 6%, these homeowners have a financial incentive to stay put, avoiding the trade of their low mortgage rates for higher ones on a new home. This phenomenon, known as rate lock-in, constrains the supply of homes available for sale, even amidst strong demand.

However, there is a glimmer of hope. While many wish to retain their low-rate mortgages, people often outgrow their homes, feel the need to downsize, relocate, or simply desire a change of scenery. In a YouTube commentary, Simonsen highlighted an 18% surge in home listings in the first week of February compared to the previous week. He noted, “Each week, we can see more sellers testing the market. More buyers are finding their opportunities as well.” Consequently, the inventory of unsold homes continues to grow, offering buyers a wider selection & potentially limiting the upward trajectory of prices.

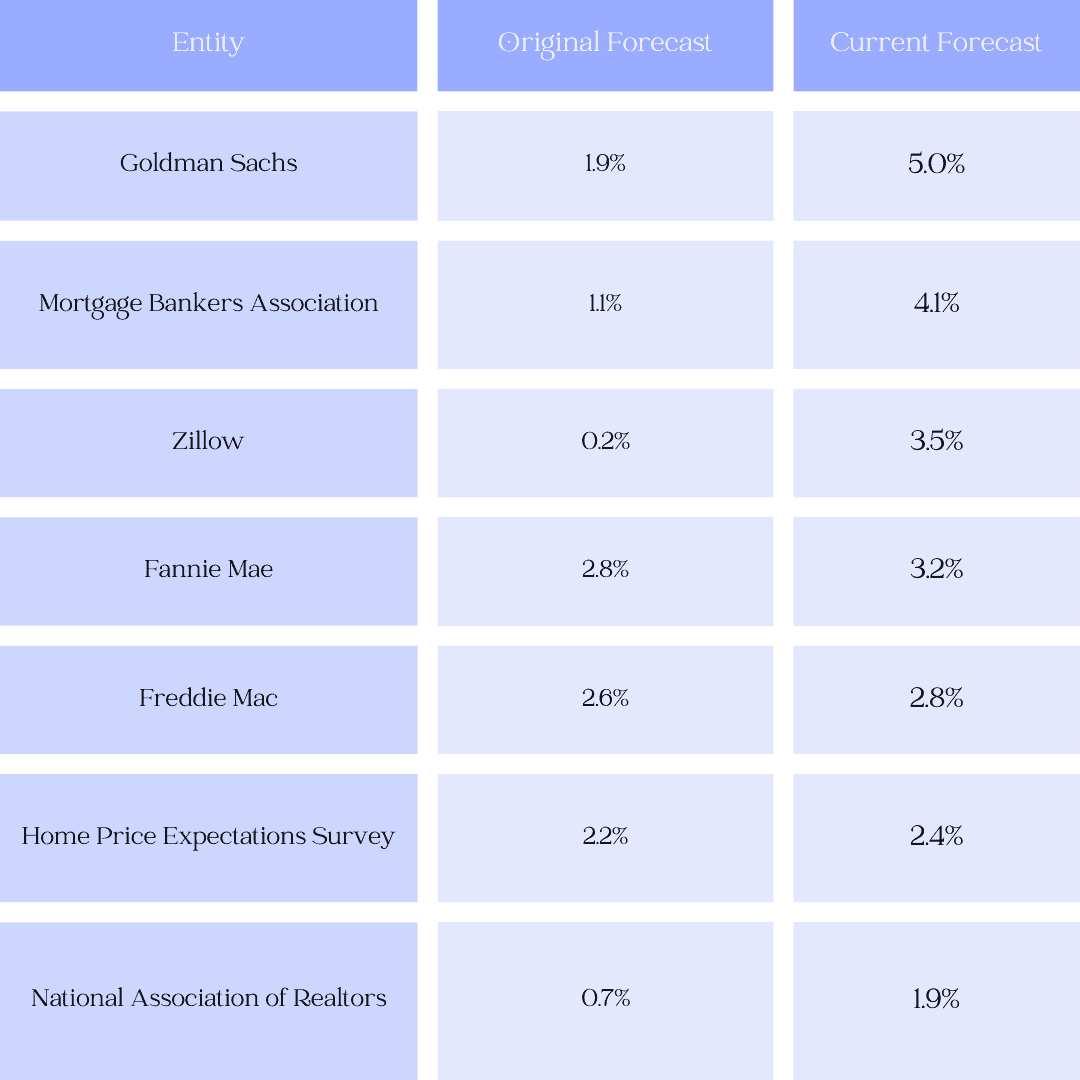

Comparison of 2024 Home Price Forecasts: Initial Projections vs. Current Outlook

In recent months, experts have reassessed their predictions for 2024 home prices, drawing on the most recent data & market indicators. Their updated analyses reinforce heightened confidence in anticipating a rise in prices rather than a decline.

The chart illustrates the initial 2024 home price forecasts made by seven expert organizations at the end of 2023, juxtaposed with their latest projections, showcasing the adjustments in their predictions.

If they trend down as the year goes on, as they’re expected to do, that could lead to more buyer demand & even higher home price forecasts

It’s all about supply & demand. With supply still so limited, anything that causes demand to go up will likely cause prices to go up, too.

Should this partially optimistic scenario prove true, the foremost guidance for those considering home purchases in 2024 is to brace for competition when submitting an offer on a property. Secure pre-approval for a mortgage, be prepared to compromise on finding a “good enough” home rather than an ideal one, & in the event of losing a bidding war, regroup & persist in the search.

Are We Headed for a Housing Crash?

If you’re holding out hope that the housing market is going to crash & bring home prices back down, here’s a look at what the data shows. And spoiler alert: that’s not in the cards. Instead, experts say home prices are going to keep going up.

Today’s market is very different than it was before the housing crash in 2008. Here’s why.

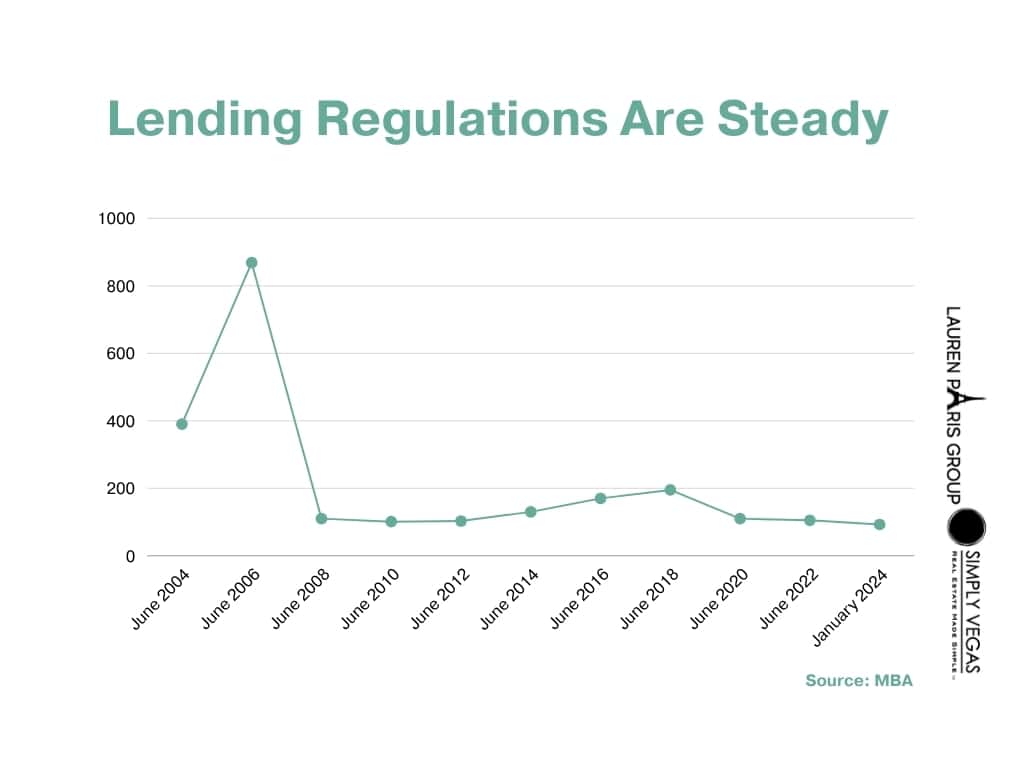

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for just about anyone to qualify for a home loan or refinance an existing one.

It’s harder to get a loan now – & that’s actually a good thing!

Things are different today. Homebuyers face increasingly higher standards from mortgage companies. The graph below uses data from the Mortgage Bankers Association (MBA) to show this difference. The lower the number, the harder it is to get a mortgage. The higher the number, the easier it is.

Back then, lending standards weren’t as strict as they are now. That means lending institutions took on much greater risk in both the person & the mortgage products offered around the crash. That led to mass defaults & a flood of foreclosures coming onto the market.

There Are Far Fewer Homes for Sale Today, so Prices Won’t Crash

What’s Next for Home Prices?

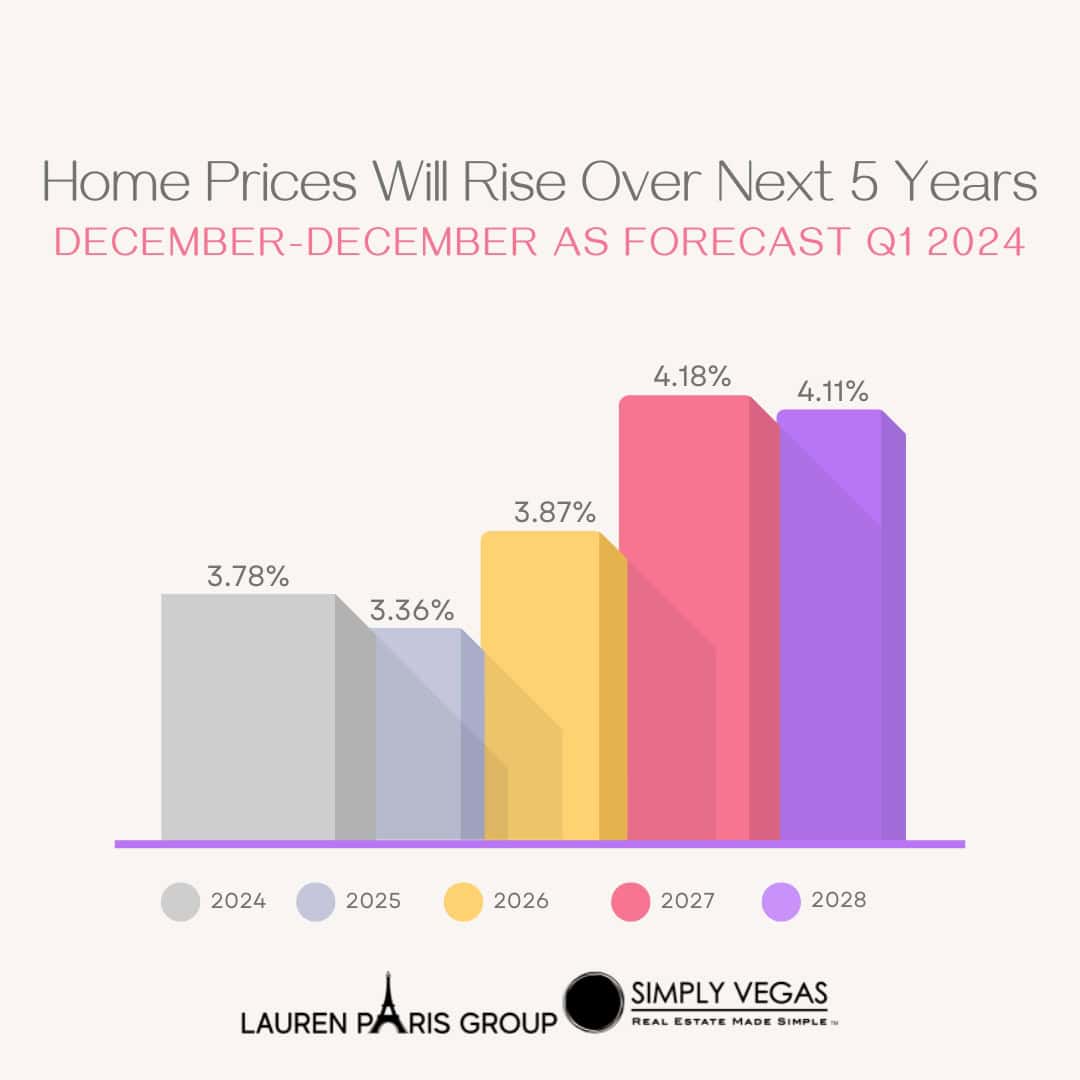

One reliable source for home information price forecasts is the Home Price Expectations Survey from Fannie Mae – a survey of over one hundred economists, real estate experts, & investment & market strategists.

According to the most recent release, experts are projecting home prices will continue to rise at least through 2028.

While the percent of appreciation varies year-to-year, this survey says we’ll see prices rise (not fall) for at least the next 5 years, & at a much more normal pace.

What does that mean for your move? If you buy now, your home will likely grow in value & you should gain equity in the years ahead. But, based on these forecasts, if you wait & prices continue to climb, the price of a home will only be higher later on.

Will Mortgage Rates Come Down?

This is the million-dollar question in the industry. And there’s no easy way to answer it. That’s because there are a number of factors that are contributing to the volatile mortgage rate environment we’re in. Odeta Kushi, Deputy Chief Economist at First American, explains:

“Every month brings a new set of inflation & labor data that can influence the direction of mortgage rates. Ongoing inflation deceleration, a slowing economy & even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

What happens next will depend on where each of those factors goes from here. Experts are optimistic rates should still come down later this year but acknowledge changing economic indicators will continue to have an impact. As a CNET article says:

“Though mortgage rates could still go down later in the year, housing market predictions change regularly in response to economic data, geopolitical events & more.”

So, if you’re ready, willing, & able to afford a home right now, partner with a trusted real estate advisor, like me, to weigh your options & decide what’s right for you.

Let’s connect to ensure you have the latest information available on home prices & mortgage rate expectations. Together we’ll go over what the experts are saying so you can make an informed decision on your move.