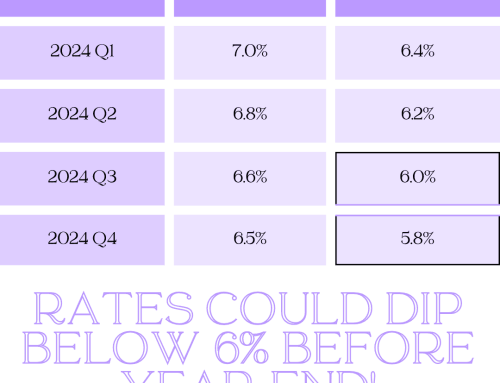

Mortgage Rates

If you’re considering purchasing a home this year, it’s essential to keep an eye on the ever-fluctuating mortgage rates. Given that mortgage rates have a direct bearing on your purchasing power when securing a home loan, and in light of the current affordability challenges, it’s wise to delve into the broader context of historical mortgage rate trends as compared to the present. Grasping their correlation with inflation can provide valuable insights into the potential future of mortgage rates in the immediate future.

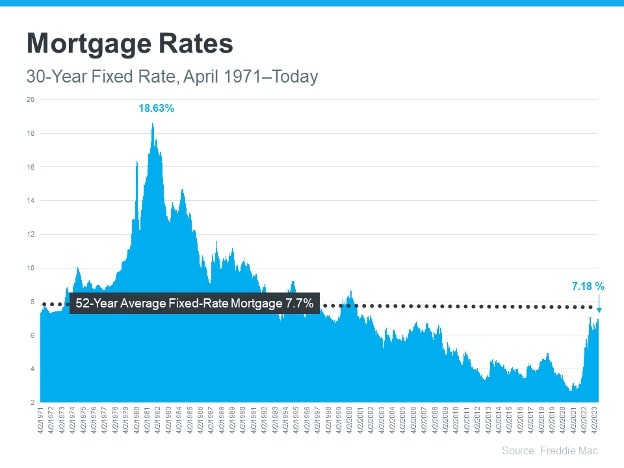

Freddie Mac has diligently monitored the 30-year fixed mortgage rate since April 1971. On a weekly basis, they disseminate the findings of their Primary Mortgage Market Survey, a compilation of mortgage application data from lenders spanning the nation.

The Sticker Shock

On the right side of the graph, we can see a notable increase in mortgage rates since the beginning of the previous year. Even with this uptick, rates remain below the 52-year average. It’s crucial to recognize that buyers have grown accustomed to mortgage rates ranging from 3% to 5% over the past 15 years.

This observation holds significance because it elucidates why the recent surge in rates might be causing a sense of sticker shock, despite their proximity to the long-term average. While many buyers have adapted to the higher rates in the past year, a slightly lower rate would undoubtedly be a welcomed development.

What Lies Ahead for Mortgage Rates?

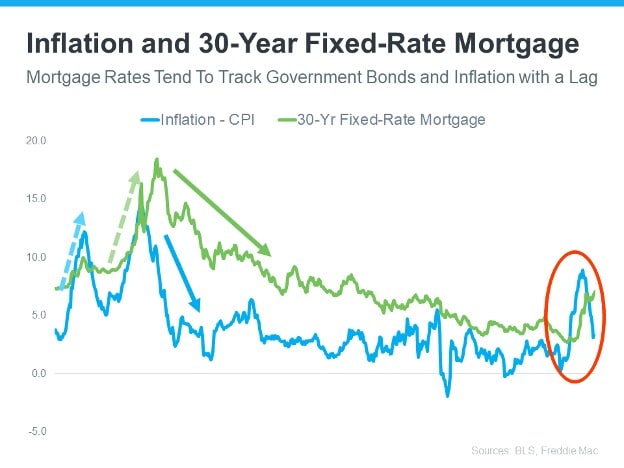

Since the beginning of 2022, the Federal Reserve has been diligently striving to reduce inflation. This is an important development because, historically, there has existed a discernible link between inflation levels and mortgage rates.

This graph illustrates a fairly consistent correlation between inflation and mortgage rates. On the left side of the graph, we can observe that whenever there is a significant shift in inflation, mortgage rates tend to follow suit shortly thereafter.

The circled segment of the graph highlights the most recent surge in inflation, with mortgage rates closely trailing behind. While inflation has shown some moderation this year, mortgage rates have not yet mirrored this decline.