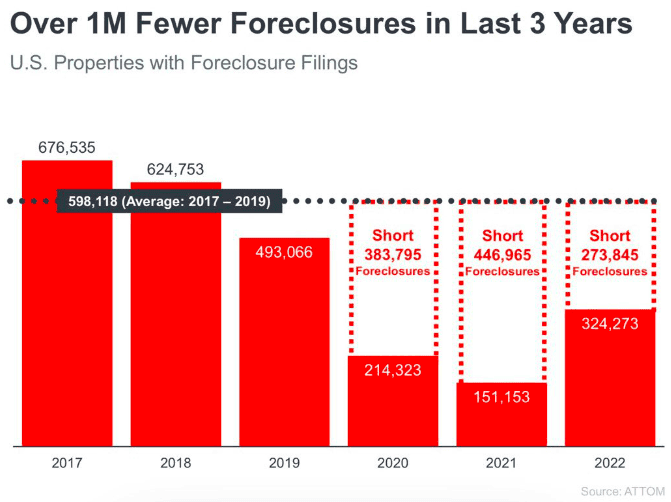

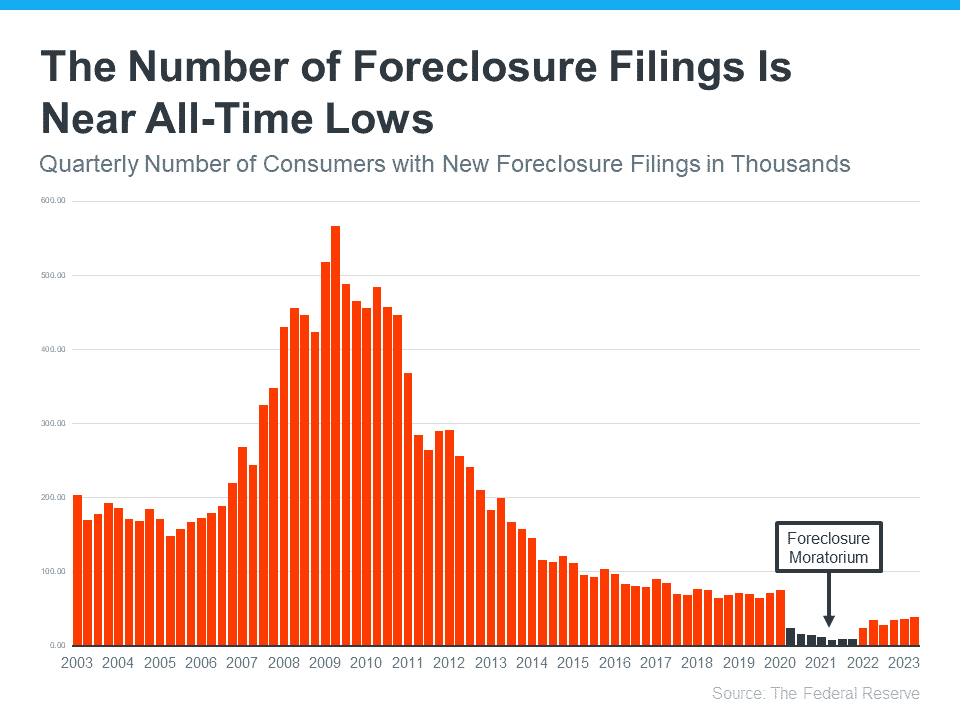

Foreclosures are the lowest they have been in 23 years.

Why Today’s Housing Market Is Not About To Crash

There’s been concern lately that the housing market is headed for a crash. But the data clearly shows today’s market is very different than it was before the housing crash in 2008. Rest assured, this isn’t a repeat of what happened back then. Here’s why.

It’s Harder To Get a Loan Now

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for just about anyone to qualify for a home loan or refinance an existing one. As a result, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices.

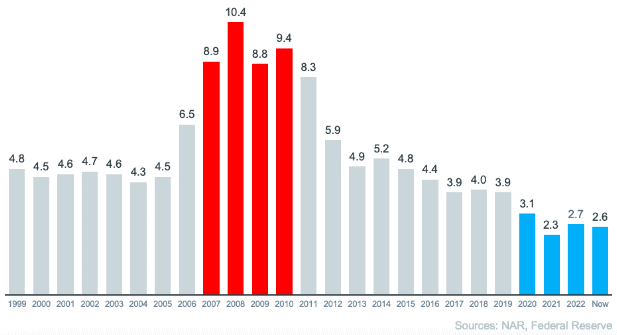

Things are different today as purchasers face increasingly higher standards from mortgage companies. The lower the number, the harder it is to get a mortgage. The higher the number, the easier it is.

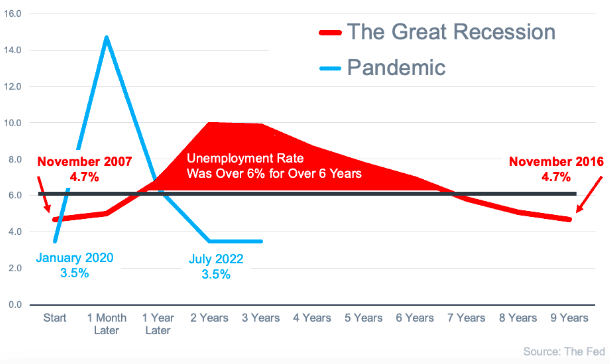

Unemployment Recovered Faster This Time

While the pandemic caused unemployment to spike over the last couple of years, the jobless rate has already recovered back to pre-pandemic levels. Because so many people are employed today, there’s less risk of homeowners facing hardship and defaulting on their loans. This helps put today’s housing market on stronger footing and reduces the risk of more foreclosures.

Equity Levels Are Near Record Highs

That low inventory of homes for sale helped keep upward pressure on home prices over the course of the pandemic. As a result, homeowners today have near-record amounts of equity.

There Are Far Fewer Homes for Sale Today

Today, there’s a shortage of inventory available overall, primarily due to years of underbuilding homes. Unsold inventory sits at just a 2.6-month supply. There just isn’t enough inventory on the market for home prices to come crashing down like they did in 2008.

Housing News

Resilient Housing Amid Affordability Crunch – According to the latest look from Fannie Mae’s Economic and Strategic Research Group, the housing market remains unexpectedly strong. The group’s monthly forecast notes that buyer demand and home prices have shown resilience since last year’s mortgage rate hikes. This is due to the still lower-than-normal number of homes for sale. Although the inventory of homes available is low, this supports home prices, even when demand dips. Demand has persisted. Fannie Mae’s senior VP and chief economist, Doug Duncan, says home buyers’ response to affordability conditions gives the group confidence housing will help cushion expected economic volatility. *More at fanniemae.com

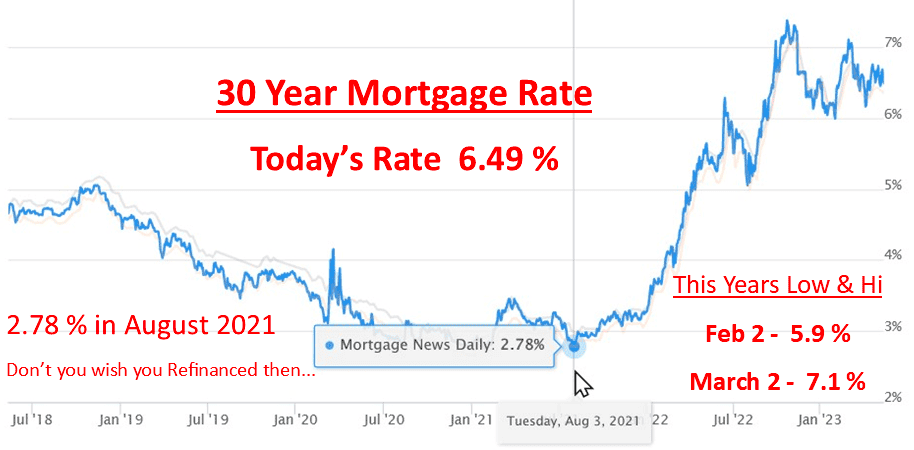

Mortgage News

Mortgage Demands Heightens – Demand for mortgage applications heightened last week from one week earlier, according to the Mortgage Bankers Association’s Weekly Applications Survey. In both purchase and refinance activity, overall demand was up 3.7% week-over-week. MBA’s VP and deputy chief economist, Joel Kan, states that rates moved up because of Treasury yields. Kan shares, “As a result of the higher yields, mortgage rates increased for the second straight week to their highest level in over a month.” The MBA’s weekly survey has been conducted since 1990 and covers 75% of all retail residential mortgage applications. *More at mba.org

Finance News

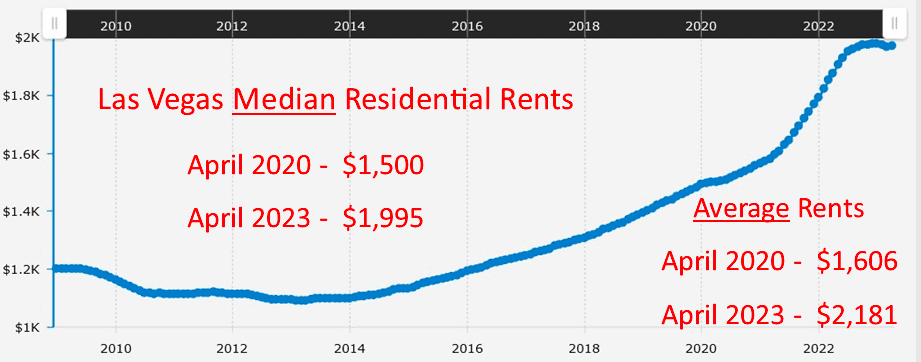

Bidding Wars for Affordable Homes – A new analysis showed that the type of home you are in the market for may determine how much competition you could face from other home buyers this Spring. This new analysis splits the housing market into three tiers depending on price. The results showed the bottom third of the housing market is more competitive than the middle and top tiers. Entry-level home buyers are more likely to find themselves in a bidding war than buyers of more expensive homes would be. This effect can be seen in recent home price increases. While the least expensive homes have seen an 8% increase, more expensive houses have seen a %1 fall over the past year. *More at cision.com

Economic News

New Construction Brings Hope for Housing – The number of new homes under construction can be a good indicator of housing market health. If home builders feel buyer demand is about to plummet, they are not likely to be building homes. That is why new numbers from the U.S. Census Bureau, the Department of Housing, and Urban Development are good news for anyone looking to get into the market. The most recent data from the New Residential Construction report, showed the number of homes that began building in March were 2.7% higher than the month before. Alike, permits to build single-family homes rose by 4.1%. They are both signs that the inventory of new homes for sale will heighten in the months ahead. *More at census.gov

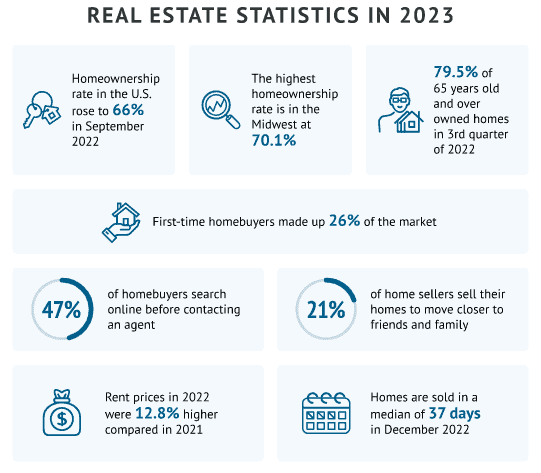

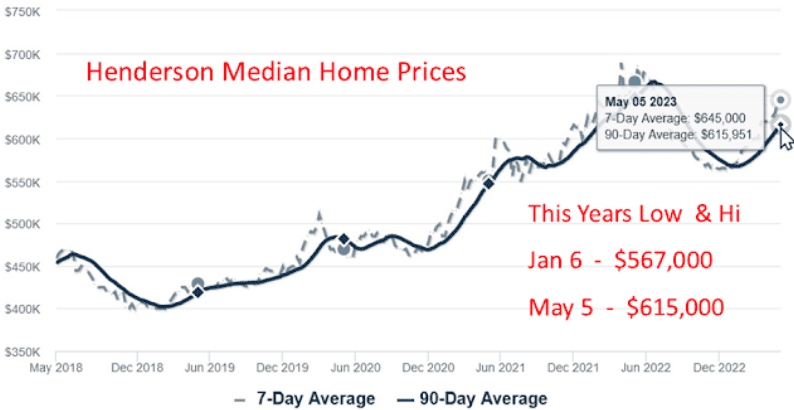

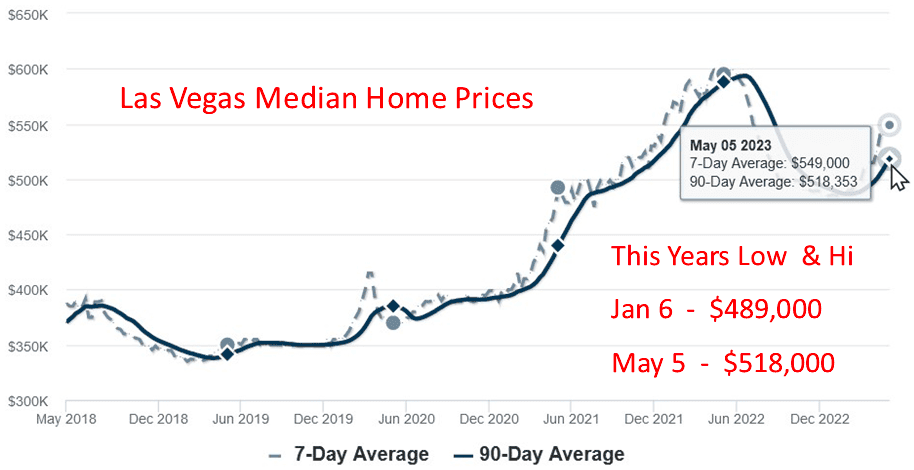

Statistics in 2023

Real estate statistics in the United States offer valuable data-driven insights to agents, brokers, investors, and clients about the ever-changing housing market. This information can be especially useful when looking to buy or sell a home, listing or searching for rental properties, or representing clients in the current market. By examining the most recent figures on local median home sale prices, mortgage rates, homeownership rates, existing home sales, and rent prices, we can provide a precise and up-to-date assessment of the current state of the real estate market.

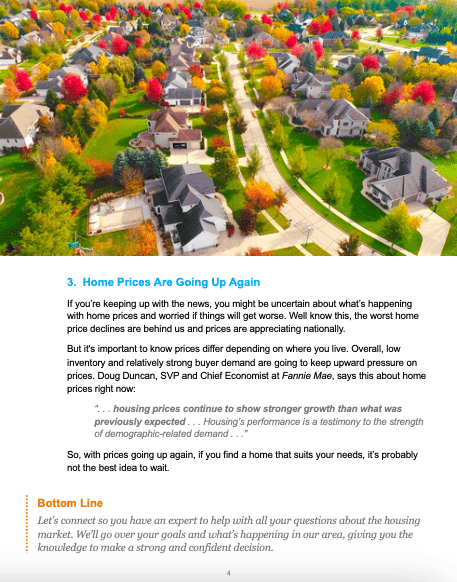

You might want to BUY NOW before the next surge…

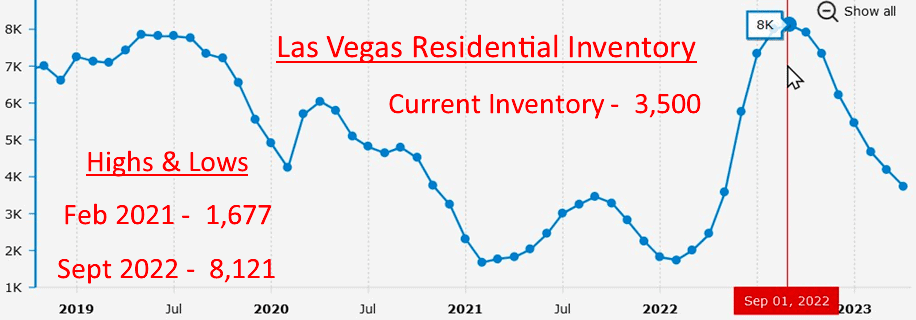

Low Inventory

A key factor to consider is the low inventory of homes for sale. This indicates an under-supply situation, in contrast to the past when there was an oversupply. For a market crash to occur, an excess of houses for sale would be required, yet the available data does not support such a scenario.

The housing supply primarily originates from three principal sources:

- Homeowners opting to list their properties for sale.

- Newly constructed residential units.

- Distressed properties, which encompass foreclosures or short sales.

Homes For Sale

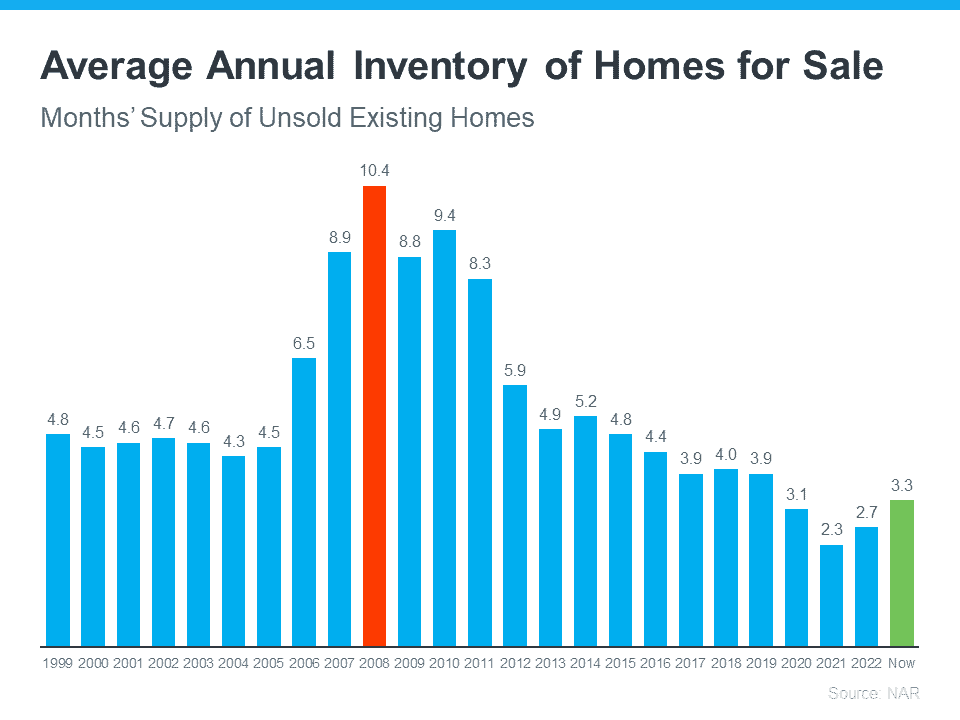

While there has been an increase in housing supply when compared to the previous year, it remains at a relatively low level. The current month’s supply is below what is typically considered the norm. This disparity is illustrated more distinctly in the graph below. Upon examining the most recent data (depicted in green) in comparison to the data from 2008 (depicted in red), it becomes evident that today’s available inventory is only approximately one-third of what was present in 2008.

So, what does this mean? There just aren’t enough homes available to make home values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that’s not happening right now.

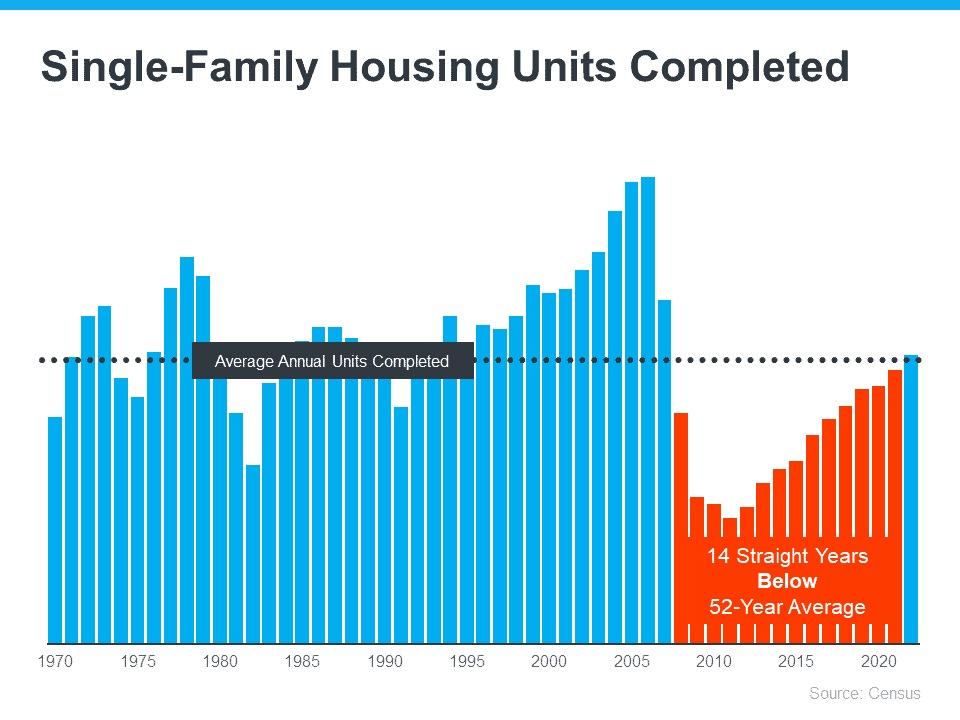

Newly Built Homes

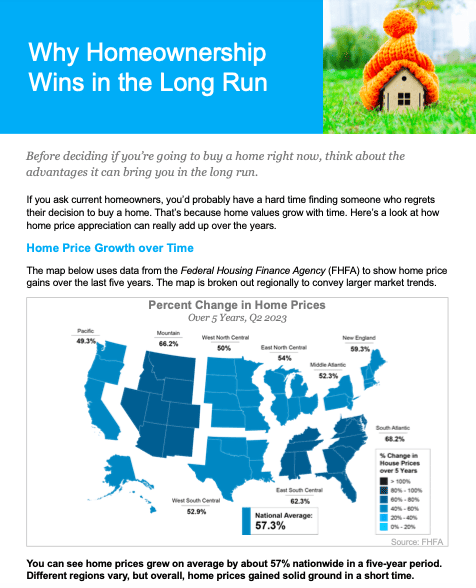

There is also considerable discussion surrounding the state of affairs in the realm of newly constructed homes, prompting speculation about whether homebuilders might be engaging in excessive construction. The graph below provides a comprehensive view of the volume of newly built houses erected over the past 52 years:

The 14-year period of underbuilding, highlighted in red on the graph, constitutes a major contributor to the current shortage in housing inventory. Over the years, builders have not constructed a sufficient number of homes, resulting in a significant supply deficit. Although the latest blue bar on the graph indicates a resurgence in construction activity, aligning with long-term averages, it is unlikely to result in an oversupply. This is primarily due to the substantial gap that needs to be bridged, coupled with a deliberate effort by builders to avoid the overbuilding seen during the housing bubble era.

Distressed Properties

The remaining source of housing inventory lies in distressed properties, such as short sales and foreclosures. During the housing crisis, a surge of foreclosures occurred due to lax lending standards that enabled many individuals to secure home loans beyond their financial means. Presently, stricter lending standards have yielded a higher proportion of qualified buyers and a marked reduction in foreclosure rates.

The graph demonstrates that as lending standards became more stringent and buyer qualifications improved, the incidence of foreclosures begin to decline. In 2020 and 2021, a combo of foreclosure moratoriums and the forbearance program effectively prevented a recurrence of the foreclosure crisis witnessed in 2008. The forbearance program introduced crucial options for homeowners, such as loan deferrals and modifications, previously unavailable to them. Data on the program’s success reveals that four out of every five homeowners exiting forbearance have either settled their dues in full or established a repayment plan to avert foreclosure. These factors constitute some of the primary reasons behind the anticipated absence of a foreclosure wave in the housing market.

What does this mean for you?

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash.

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing inventory tells us there’s no crash on the horizon.

Contact Lauren Paris to chat about the current market conditions and how it affects you!