Home Equity

Did you realize homeowners can increase their down payment when purchasing their next home? The reasoning for this lies in the potential to utilize the equity in their current home once it is sold. As home equity surges, so does the median down payment.

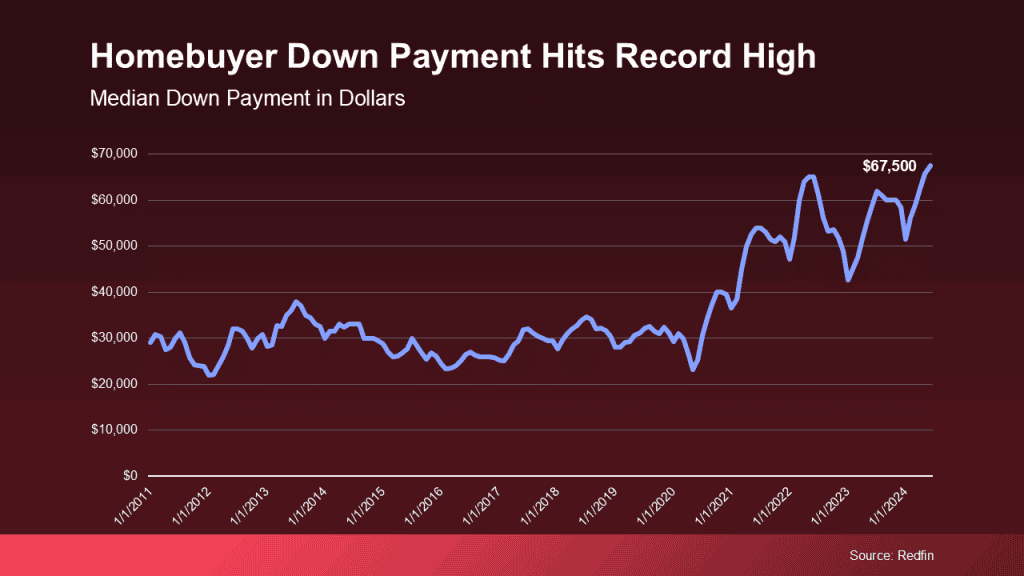

Data from Redfin reveals that the standard down payment for U.S. homebuyers is currently $67,500. This is an impressive 15% increase from the previous year and is the highest it’s ever been (refer to graph).

So how does equity make this possible? Over the last five years, home prices have certainly risen. This gives homeowners like yourself a significant equity increase. If you decide to sell and relocate, you can use this equity towards a larger down payment on your new home. This can be a significant opportunity, especially for those concerned about affordability.

A substantial down payment isn’t necessary to buy your next home. There are loan programs available that require as little as 3%, or even 0% down. However, a larger down payment comes with considerable benefits.

Why a Larger Down Payment Can Be a Game-Changer

- Borrow Less, Save More in the Long-Term

By utilizing your home equity toward a larger down payment, you reduce the amount needed to borrow. Consequently, your overall interest paid throughout the loan is reduced, leading to long-term savings.

- Lower Monthly Payments

A larger down payment not only reduces the amount needed to borrow but can also result in a smaller monthly mortgage payment. This makes your new home more affordable and allows more flexibility in your budget.

- Possibility of a Reduced Mortgage Rate

A substantial down payment signals to your lender that you are financially reliable and not a high credit risk. The higher their confidence in your credit score and repayment ability, the more likely you will secure a lower mortgage rate. This can amplify your savings even further.

- Avoid Private Mortgage Insurance (PMI)

When you put down 20% or more, you can bypass Private Mortgage Insurance (PMI), an additional cost for many buyers with a smaller down payment. As explained by Freddie Mac:

“For homeowners who put down less than 20%, Private Mortgage Insurance or PMI is an additional policy that protects the lender if you fail to pay your mortgage. It is not homeowner’s insurance. If your down payment is less than 20%, it’s a monthly fee rolled into your mortgage payment.”

By avoiding PMI, you reduce your monthly expenses.

The Bottom Line

Down payments are at an all-time high, primarily due to homeowners benefiting from recent equity gains.

If you’re considering selling your current house and relocating, let’s collaborate to determine your current home equity and how it can enhance your buying power in today’s market. With over 20 years of experience, local knowledge, and valuable contacts, I ensure you have the information and resources needed to make confident decisions when buying your next home. Source: mykcm.com