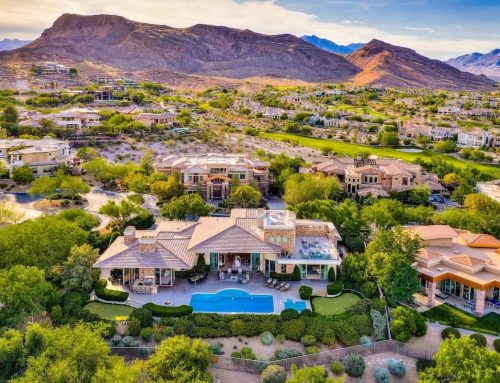

Why Now is the Time to Buy a Home

In today’s rapidly changing economic landscape, one thing remains clear—the urgency of buying a home sooner rather than later. For generations, homeownership has been the bedrock of wealth accumulation in America. Yet, many from the younger generation believe renting is more convenient and worry about the perceived burdens of home maintenance. But let’s take a closer look at why this mindset could be costing you dearly in the long run.

Homeownership vs. Renting

Most young adults are content to spend $2,000 to $4,000 a month on rent, equating to $24,000 to $48,000 a year. But what does this money actually get you? In essence, it pays your landlord’s mortgage while you walk away with nothing to show for it. With rent prices soaring, the cost difference between owning and renting is shrinking. Therefore, investing in a home becomes not just a financial decision, but a smart move for your future.

Rising Rent & Hedge Fund Takeovers

The rental market is on an upward trajectory. Rent prices are climbing, and hedge fund companies are snapping up properties to convert into rental units. Their goal? To turn America into a nation of renters. While the demand for rental properties is high, the better option is to invest in yourself by purchasing a home. Why continue to funnel money into someone else’s investment portfolio when you can build your own wealth?

Counterarguments & Rebuttals

“Renting is more flexible and doesn’t tie you down.”

While it’s true that renting offers short-term flexibility, homeownership provides long-term stability and wealth accumulation, owning a property means building equity that you can eventually leverage.

“Home ownership is too expensive for younger generations.”

This is a common misconception. With various first-time homebuyer programs and historically low interest rates, owning a home may be more accessible than you think. Monthly mortgage payments often rival rent costs, making homeownership a feasible option.

“The housing market is unpredictable, and I don’t want to risk losing money in a downturn.”

Real estate has consistently proven to be a sound investment over time. While markets fluctuate, careful research and financial planning can mitigate risks. Over the long term, the value of real estate tends to appreciate.

Supporting Data

- Wealth from Homeownership: According to a Federal Reserve survey, homeowners have a net worth 44 times greater than renters.

- Rent vs. Buy Trends: Studies indicate that in many markets, the cost of buying is becoming comparable to renting, especially considering long-term financial benefits.

- First-Time Buyer Programs: Numerous programs offer down payment assistance and lower interest rates to make homeownership achievable for first-time buyers.

If you’re contemplating buying a home, now is the time to act. The longer you wait, the more you can pay rent, and the more challenging it may become to enter the housing market. Take the first step toward securing your future today. Contact the Lauren Paris Group and let’s get started on this exciting journey together.