Considering Purchasing a Home but Hesitant Due to Concerns About Mortgage Rates?

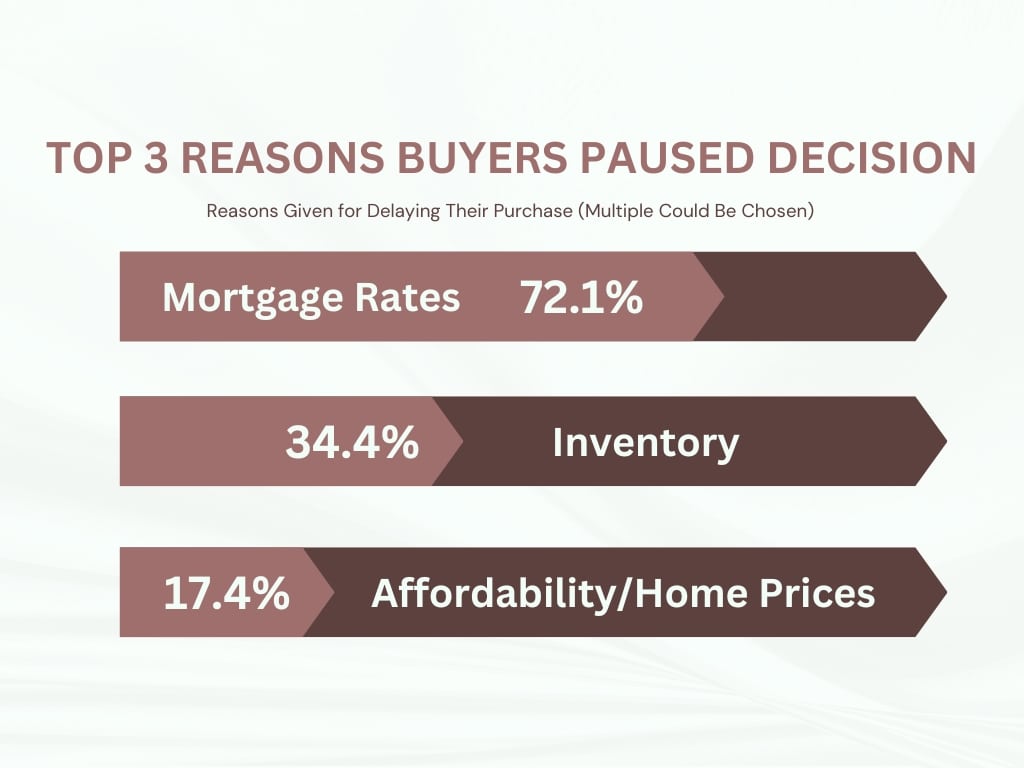

You’re not alone. Many potential buyers have found themselves in a similar position, pausing their plans as rates reached heights near 8% last year, making it challenging to align with their budget. According to data from Bright MLS, high mortgage rates have been the primary reason for delaying moves among buyers.

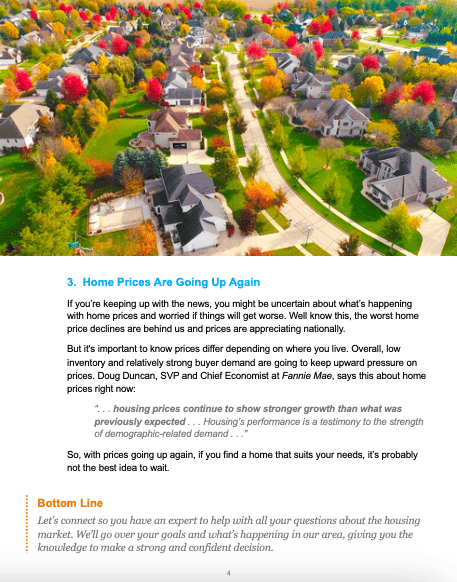

Fortunately, mortgage rates have begun to decline from their peak in October. While daily fluctuations persist, long-term projections suggest a continued decrease throughout the year, particularly if inflation stabilizes. Experts even anticipate rates dipping below 6%, a potential game-changer for many buyers.

As highlighted in a recent article from Realtor.com, the desire to purchase a home remains strong, with a significant portion of prospective buyers eagerly awaiting a drop in mortgage rates. If rates fall below 6%, four out of 10 Americans planning to buy a home within the next year would consider it feasible.

While predicting mortgage rates is challenging, the optimism expressed by experts offers hope for those who’ve postponed their plans. If you’ve been waiting on the sidelines, now might be the time to reconsider. Reflect on the rate at which you’d feel comfortable re-entering the market – whether it’s 6.5%, 6.25%, or below 6%.

Over the past two years, I haven’t closed a buyer under 5.25% because I negotiated for the seller or builder to cover my buyer’s closing costs and buy down their interest rate. I have been extremely successful with all my buyers, particularly with new home builders. With the right negotiator, there is a solution to securing a lower rate. Additionally, when the seller pays your points, it’s even a tax write-off—a true win-win.

Let’s Get the conversation started

Once you’ve determined your target rate, reach out to a local real estate professional, like myself. I’ll keep you updated on market developments and notify you when rates align with your criteria.

In essence, if high mortgage rates have delayed your plans to move, it’s worth considering the threshold that would prompt you to re-enter the market.

(702) 768-8940 | LP@LaurenParis.com | LaurenParis.com