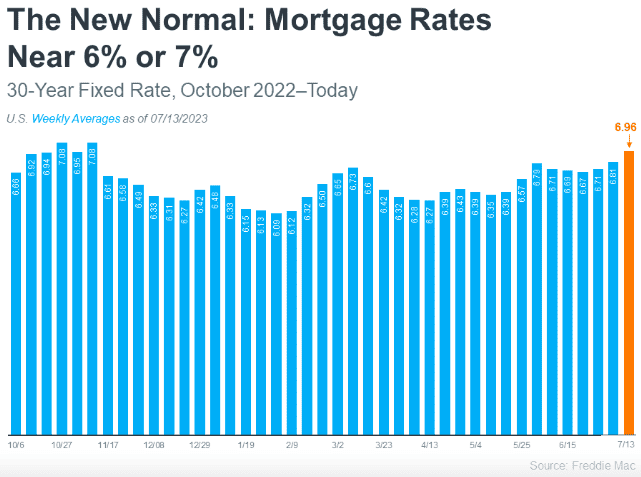

Homebuyers Are Getting Used to the New “Normal”

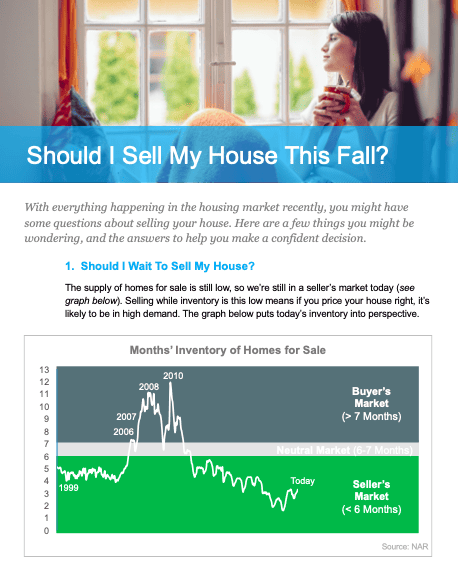

Prior to making the decision to sell your house, it is crucial to familiarize yourself with the prevailing conditions of the housing market. A noteworthy development in the present scenario is that potential homebuyers are effectively adjusting to the current mortgage rates and accepting them as the prevailing standard.

Sellers: Home Sales are Consistent Right Now!

For sellers, receiving news of steady home sales is indeed encouraging as it signifies the presence of active buyers who are actively acquiring properties. During the previous year, there was a significant surge in mortgage rates, soaring from approximately 3% to 7%. This sudden increase startled many potential buyers, causing them to postpone their plans to purchase a home. As time has progressed, the initial shock has subsided. Buyers have become more accustomed to the current mortgage rates and have acknowledged that the historically low rates observed in the past few years are no longer prevalent.

A recent survey conducted by Freddie Mac, approximately 18% of the respondents expressed their intention to purchase a home within the next six months. This indicates that nearly one out of every five individuals surveyed has plans to buy a property in the near future.

It’s important to note that while mortgage rates play a big role in buyer demand, they are not the sole determining factor. Regardless of the mortgage rates, individuals will always have various reasons to relocate, such as job changes, household adjustments, or personal motivations. As a seller, you can be confident that there is indeed a market for your house in the present time. The demand remains robust as buyers are adjusting and becoming comfortable with the current interest rate environment.