The Las Vegas Housing Market Isn’t Headed for a 2008-Style Crash

And what that means for buyers, sellers, and savvy investors →

If you’ve been watching the headlines lately, you might be getting some déjà vu vibes. Rising home prices, affordability challenges, more listings hitting the market—sound familiar? For those of us who lived through the 2008 housing crisis, it’s natural to wonder: Are we headed for another crash?

The short answer? No. Despite what the internet doomscrollers might claim, the housing market in 2025—both nationally and here in Las Vegas—is nothing like it was in the lead-up to the Great Recession. Let’s walk through exactly why today’s market is standing on much stronger ground—and why experts are standing firm in their belief that history isn’t about to repeat itself.

Inventory: Low Supply Is Still the Name of the Game

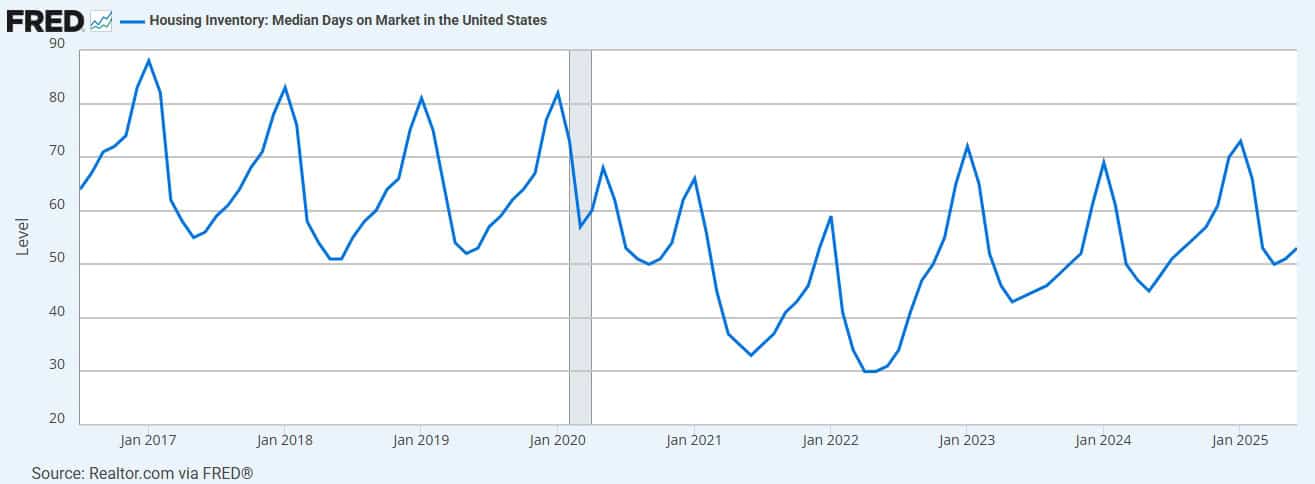

Back in 2008, the market was flooded with homes. Inventory skyrocketed, homes sat for months (or years), and prices fell off a cliff. Today’s story? It’s a different plot entirely.

While housing inventory has grown modestly this year—rising from about 1.45 million to 1.54 million homes nationwide—we’re still well below pre-pandemic norms. In fact, we’re short about 4 million homes in the U.S., according to recent data from Realtor.com and Investopedia. Even with more homes hitting the market this spring and summer, it’s not enough to meet demand, especially in sought-after areas like the Las Vegas Valley.

Buyers are active, but sellers aren’t flooding the market. And without a massive surplus of homes, prices don’t typically tumble—they stabilize or grow more slowly, which is exactly what we’re seeing now.

New Construction: Builders Are Playing It Smart

One of the major drivers of the 2008 crash was overbuilding. Developers couldn’t hammer nails fast enough, and by the time buyers vanished, there was a sea of empty new builds with no one to fill them.

Today’s builders are much more measured. Single-family housing starts have pulled back slightly in early 2025—down nearly 10% in May compared to the same time last year—and many developers are choosing to finish existing projects rather than launch new ones. Why? Because they’re still playing catch-up from years of underbuilding after the last crash.

In Las Vegas, new home communities are still popping up, but at a sustainable pace. Builders aren’t overshooting demand—they’re trying to meet it.

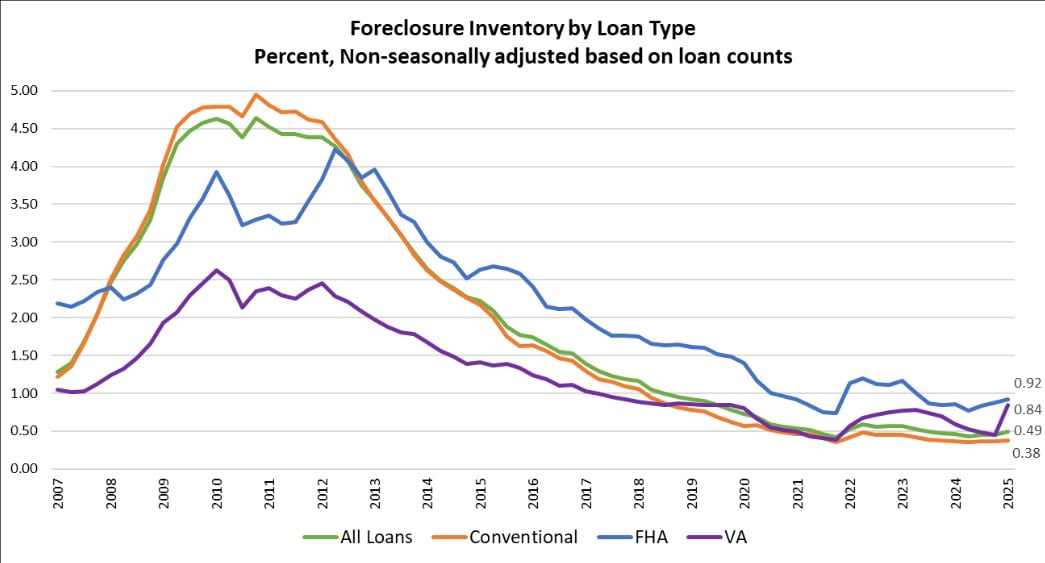

Lending Standards: No More Wild West Mortgages

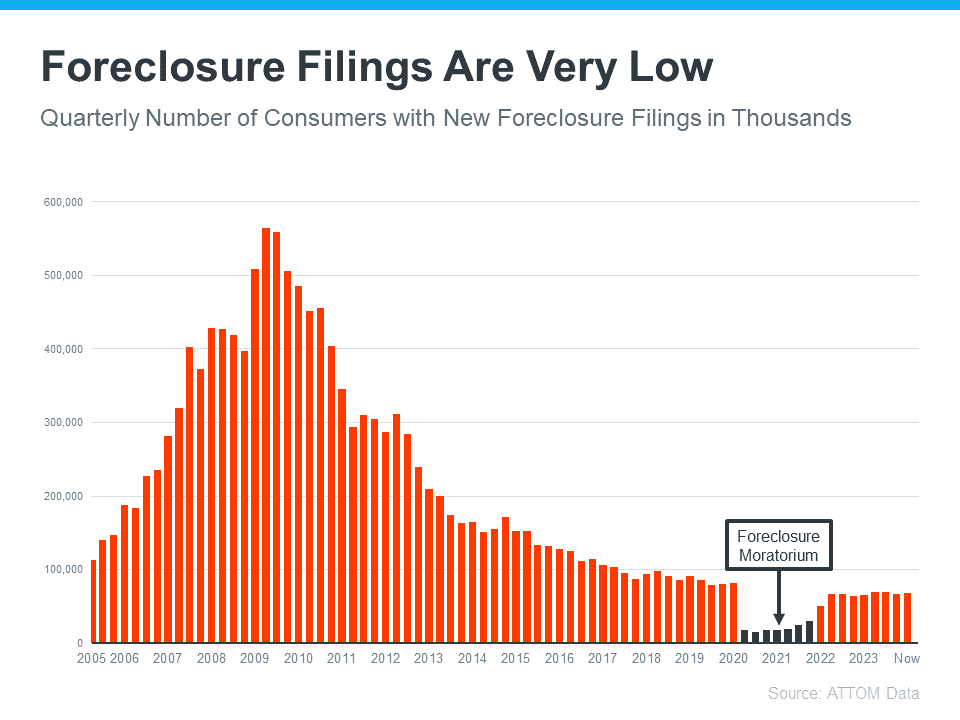

Another major difference? Mortgage lending isn’t the free-for-all it once was. In the early 2000s, loans were handed out like candy on Halloween. You could get a mortgage without proving your income, creditworthiness, or financial stability—and many did. That’s what led to a tidal wave of foreclosures and a broken system.

Fast-forward to today, and lending rules are far tighter. Buyers must qualify with full documentation, stronger credit, and better debt-to-income ratios. As a result, the number of distressed properties—foreclosures and short sales—remains historically low.

Yes, foreclosure filings are slowly ticking up from the extreme lows of the pandemic-era moratoriums, but they’re still well below what’s considered normal. According to the Mortgage Bankers Association, the foreclosure inventory rate remains under half a percent—nowhere near crisis levels.

Affordability Concerns: The Wild Card No One Saw Coming

While lending standards are safer and inventory remains tight, affordability has become a new kind of challenge—especially for first-time buyers. Mortgage rates remain in the 6–7% range, and property insurance costs have surged nationwide.

In fact, home insurance premiums jumped more than 20% between 2022 and 2024 and are expected to rise again this year. In some areas, buyers are struggling to afford both their mortgage and their insurance payments—something that’s already leading to payment stress in places like Florida, California, and yes, even parts of Nevada.

This doesn’t mean a crash is coming—but it’s a reminder that buyers should be working with a savvy lender and realtor to factor all costs into the equation, not just sale price.

The Las Vegas Perspective: What You Need to Know Locally

In the Las Vegas metro area, we’re seeing some markets shift toward a more balanced pace. Homes are taking slightly longer to sell—averaging around 53 days on market in June 2025, compared to 45 this time last year. Some sellers are adjusting prices, particularly in the higher-end segments where inventory is more saturated.

But here’s the kicker: homes that are well-priced and well-presented still move quickly. Demand is strong, especially among out-of-state buyers seeking sunshine, tax benefits, and lifestyle communities like Summerlin, Henderson, and Lake Las Vegas.

Whether you’re buying or selling, the key is timing and preparation—not fear of a crash that simply isn’t in the cards.

Final Thoughts: This Isn’t 2008

Let’s recap what’s really going on:

- We don’t have a flood of homes on the market.

- Builders are cautious, not careless.

- Buyers are more qualified.

- Distressed sales are rare.

- Lending rules are strict.

- Price growth is slowing, not collapsing.

And while affordability concerns are real—and worth addressing—there’s no sign of the market imploding. Instead, we’re seeing a normalization. A balancing. A healthy recalibration after a wild ride.

Buyers, Sellers, & Investors

Buyers: The market is still competitive, but you’ve got more breathing room. Work with an agent who knows how to negotiate and help you get creative with financing or seller concessions.

Sellers: You’re still in a great position. Pricing and presentation matter more than ever—homes that shine and are priced right still win.

Investors: Watch affordability metrics and local migration trends. Las Vegas remains a magnet for growth, especially in the luxury and retirement markets.

Want to Dig Deeper?

I’ve written over 200 educational blogs about the real estate market—from first-time buying tips to high-level investor strategy. If you’re looking for more context or have questions this blog didn’t cover, I’d love to connect and help you make smart, confident moves in this market.