A helpful guide

Considering selling your home? It’s crucial to get a clear grasp on the equity of your home before making a move. With home prices skyrocketing in recent years, many might be pleasantly surprised to find that they possess more equity than expected.

Let’s dive deeper into what you should know when you’re planning to capitalize on your investment and invest your equity into your next dwelling.

Understanding Home Equity: What it is, & How Much Have You Accumulated?

Essentially, home equity is the monetary difference between the market value of your house and the amount you owe on your mortgage. Suppose your house is valued at $400,000 and you owe $200,000 on your mortgage. Then, your equity stands at $200,000.

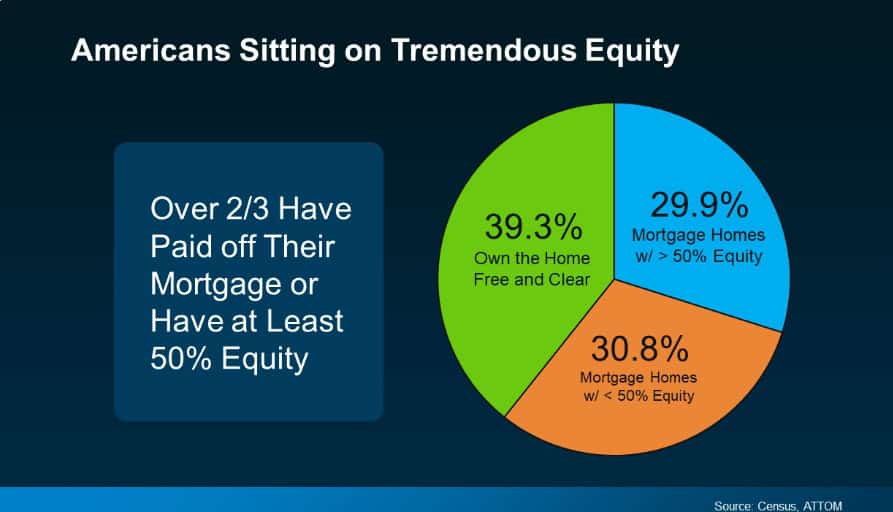

According to recent statistics from the Census and ATTOM, Americans have accrued significant equity today. Astonishingly, over two-thirds of the homeowners have either fully paid off their mortgages or have at least 50% equity in their homes.

Presently, homeowners are reaping larger returns on their investment in homeownership when they decide to sell. Having substantial equity could become a potent tool to facilitate your next move.

Guidance on Your Next Steps

Thinking about putting your house on the market? Knowing your equity and understanding the implications on your sales and potential profits is vital. Teaming up with an expert agent and seeking advice from tax or financial professionals can help you gain a clear vision of your unique situation and chart out the way forward.

The Bottom Line

As home prices have escalated, your equity likely has too. Let’s get together so you can comprehend how much equity you’ve accumulated in your home and proceed with assurance when you’re ready to sell.