Have you been tossing the idea around of finally not renewing your lease? I am here to help you decide what route to take. Buying a home is a simple process if you are working with a quality realtor who knows that process and knows how to overcome obstacles with solutions in the transaction, ME!

Buying vs. Renting is one of the biggest decisions you can make! After all, we all have to pay to live somewhere. You might as well invest in yourself and your future and purchase a property, pay yourself rent and get the tax write-offs.

NOW is the time to learn the advantages and differences between buying vs. renting in Las Vegas, Henderson, and Boulder City.

As a renter, you are probably confronted with a crucial choice every year, whether to renew your existing lease, begin a new one, or purchase a home. This year is no exception, and before making any significant commitments, it is beneficial to have a clear understanding of the actual expenses involved in renting in the future. Contact Lauren Paris to discuss your exact situation and the pros and cons.

Advantages of Buying a Home in Las Vegas:

- Building equity over time

- Better Investment than throwing rent money away

- Investing in your financial future for you and your family

- Affordable prices compared to other big cities

- Locked in Mortgage Rates, so payment will always stay the same

- Low Property Taxes

Additionally building equity eventually means using your home as an investment, which is of huge importance to many. Owning a home allows you to customize it the way you and your family want and make improvements without having to get approval from a landlord. Mortgage payments are typically lower than what you would pay for rent because they are spread out over 15-30 years, as opposed to one month. Despite Las Vegas being known for a weekend getaway, it is also a great destination to put roots down and settle long-term. With its desirable weather and no state income tax, Las Vegas is becoming a popular place to start a family.

One of the advantages of owning your own home is the stability it provides in terms of monthly costs. By locking in a fixed-rate mortgage, you can ensure that your monthly payments remain the same throughout the loan’s lifespan, unlike rent payments, which may increase over time.

Homeownership is the more secure option, in the event of job loss or medical issues, lenders are generally more accommodating than landlords, offering assistance if necessary.

Other benefits of homeownership include tax deductions for interest paid and property taxes, as well as home equity growth. According to CoreLogic, the average homeowner has gained $34,300 in equity over the last year, which is modest. With every mortgage payment, you build wealth through forced savings in the form of home equity.

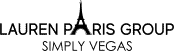

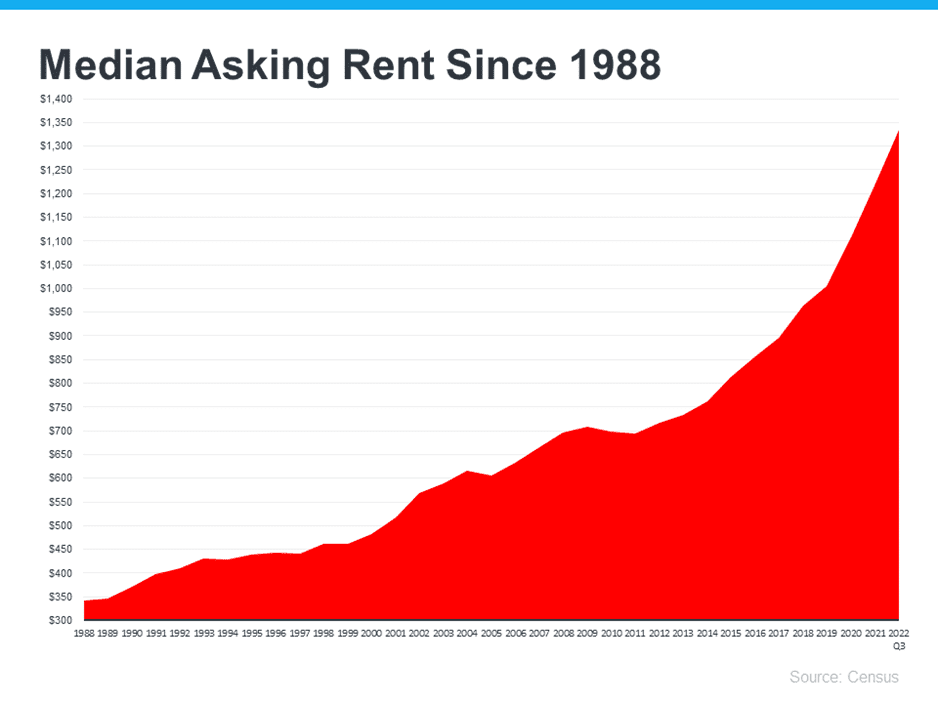

Renting long-term isn’t a sustainable plan. Here’s why:

From age 30 to 70, your rent will consistently rise, meaning the largest expense in your budget—housing—is out of your control and continually increasing. This lack of stability can cause financial strain over time. What you pay in rent today will pale in comparison to what you’ll pay in 20 years.

On the other hand, if you purchase a home with a fixed-rate 15-year mortgage, you lock in your housing costs. Once paid off, your housing expenses become minimal—just property taxes and insurance, which are far smaller than rent increases.

While renting may be a smart short-term solution, it’s not a viable plan for the future. Don’t feel pressured to buy before you’re ready, but consider stabilizing your biggest expense before it spirals out of control.

To help you decide when the right time to buy is, I’ve put together this blog about the telltale signs you’re ready to become a homeowner. Click here!

Advantages of Renting a Home in Las Vegas include:

- Fewer Living Expenses

- Potential additional Amenities

- No Long-Term Commitments

- Familiarizing Yourself to the City

Not committed to buying a home? Then renting could be the right choice for you! It offers more flexibility than owning because you don’t have to commit to any long-term maintenance or repairing things yourself – that’s what you have a landlord for! Moving out is much easier as all you must do is give notice of your departure and move on!

However, some disadvantages come along with renting, as well. One major downside is that your hard-earned money goes towards someone else’s mortgage (your landlord), instead of building equity for yourself. In addition, landlords may have restrictions on what changes/improvements renters can make to their homes. This limits the opportunity to personalize and make your home, YOUR home. You will also have to come up with the first month’s rent, security deposit, and any other key deposits, and watch out, because some rental agreements may have hidden fees such as pet deposits or utility bills which can add up quickly!

Homeownership Provides an Alternative to Rising Rents

Individual circumstances and preferences will determine whether you buy or rent a home. If stability and a potential long-term investment are important factors for you, then buying might be the right choice for you. However, if flexibility and convenience are priorities, then renting could be better suited for your lifestyle needs. When making this important decision, it is important to consider all the pros and cons when it comes to buying vs. renting. Information found on Extraspace.com

Millennial Homeownership Nationwide Rises

A recent study by RentCafe showed there has been an increase in homeownership among millennials nationwide. This increase represents a 64% rise in homeownership over the past five years. The study also revealed that this historic increase occurred in a shorter time than for previous generations. Notably, during the past few years, there have been several economic factors that may have contributed to the rise in millennial homeownership. Many millennials moved back in with their parents during COVID-19, which allowed them to save their income rather than spend it on rent. More than half of millennial homebuyers received financial help from a parent or a family member for their down payment, according to a LendingTree survey. NV Realtors President, Thomas Blanchard states, “The student loans, the unaffordable housing and — it’s just craziness, the roadblocks that the current market has given them and to see them overcome it over the last five years, hats off to them in being focused and doing the things necessary to become a homeowner.” Information found on thenevadaindependent.com

What Millennials Can Expect to Pay in Rent in Las Vegas & Henderson

Millennials are increasingly choosing Nevada as their home, drawn by its affordability and attractive lifestyle. A key factor in this decision? Reasonable rent prices across the state’s most popular areas. Let’s break down the rental costs in Las Vegas, North Las Vegas, and Henderson.

Las Vegas

- Overall Average Monthly Rent: $1,399

- One-Bedroom Rent: $1,100

- Two-Bedroom Rent: $1,334

Las Vegas offers a unique mix of urban living and outdoor adventure at an affordable price. Residents benefit from world-class entertainment, dining, and shopping, along with easy access to outdoor destinations like state parks and Lake Las Vegas. Whether you’re a professional or an outdoor enthusiast, Las Vegas strikes the perfect balance between lifestyle and cost.

North Las Vegas

- Overall Average Monthly Rent: $1,484

- One-Bedroom Rent: $1,047

- Two-Bedroom Rent: $1,275

For those seeking a quieter, suburban atmosphere without straying far from the city, North Las Vegas is an ideal option. Its slightly lower one- and two-bedroom rental rates make it an attractive choice for millennials, especially families or pet owners who appreciate the area’s abundant parks and open spaces.

Henderson

- Overall Average Monthly Rent: $1,686

- One-Bedroom Rent: $1,373

- Two-Bedroom Rent: $1,625

Henderson stands out for its family-friendly suburban vibe and strong job market. While its rent prices are slightly higher, the value is evident in the quality of life it offers, from excellent schools and career prospects to extensive recreational options, including 73 parks and thriving sports leagues. Information found on yahoo.com