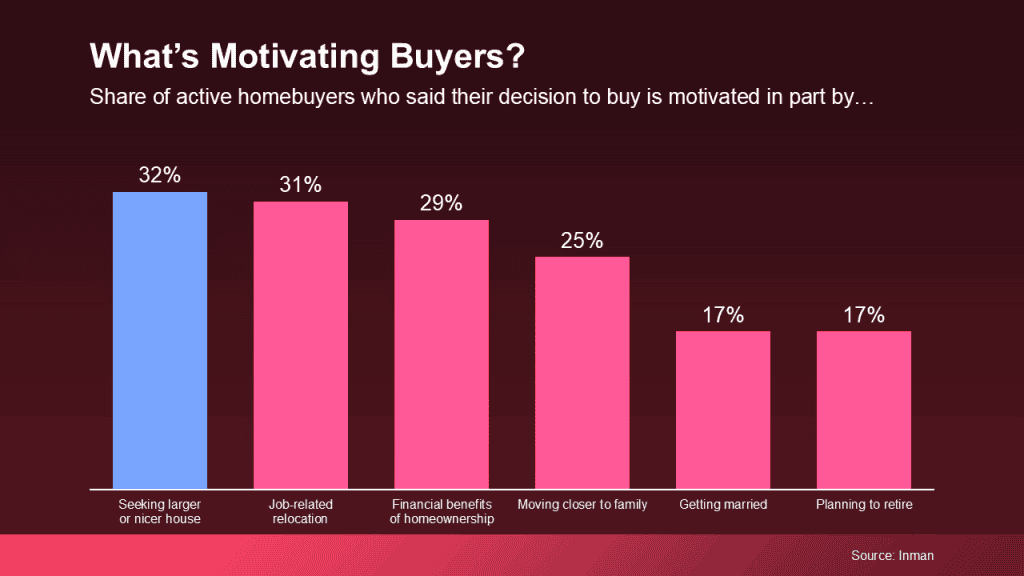

Upgrade Your Lifestyle

For those dreaming of upgrading to a more spacious or luxurious home, you’re in good company. Recent data from Inman indicates that the quest for more space or better amenities tops the list for modern-day homebuyers. However, like many others, you might have been stalling your plans due to uncertainty in the real estate market. It’s a reasonable concern; after all, an upgrade means potentially higher monthly expenses. But here’s some encouraging news: this may just be the perfect time to finally make that move.

Home Equity

One of the major perks of the current market is the probability of you having accumulated substantial equity in your existing home. Despite recent fluctuations, home prices at a national level have been on an incline, thereby boosting homeowners’ equity. Selma Hepp, Chief Economist at CoreLogic, offers some insightful perspective, stating,

“Consistent growth in home prices has fueled substantial equity gains for homeowners, with the average equity now approaching $315,000; almost $129,000 higher than before the pandemic.”

So, what does this imply for you? If you’ve owned your home for several years, the chances are that you’ve accumulated a significant amount of equity. This could be used towards your next home’s down payment, ensuring that your loan remains manageable.

Therefore, upgrading your home might be more feasible than you initially estimated. To get a better idea of how much equity you’ve earned over the years, consult with a real estate agent, like me, for a professional assessment.

Falling Mortgage Rates Boost Your Buying Power

Another enticing reason to make your move now is the decreasing mortgage rates. These lower rates can make your subsequent monthly payments more controllable, and amplify your purchasing power. As mentioned by Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR),

“Reduced mortgage rates mean the interest portion of monthly payments decreases, ultimately lowering the total payment. This enables more borrowers to qualify for mortgages that might have been unaffordable with higher rates.”

This provides you with a higher degree of flexibility when scouting for homes and may even enable you to afford a house that was previously not financially viable. A reliable lender can assist you in developing the best strategy for your budget. Reach out to me and I can set you up with one of the best!

Key Takeaways

If you’re eager to sell your current place and acquire the larger, fancier home you’ve been picturing, there’s no better time than now. Your accumulated equity combined with lower mortgage rates places you in an advantageous position to take the leap today.

To make well-informed decisions and capitalize on your current market benefits, let’s connect. It’s always beneficial to have an expert guiding you through each step of the home-buying process. With over 20 years of experience, extensive local knowledge, and valuable contacts, I ensure you have the information and resources needed to make confident decisions.