Homeownership is an Investment in Your Future

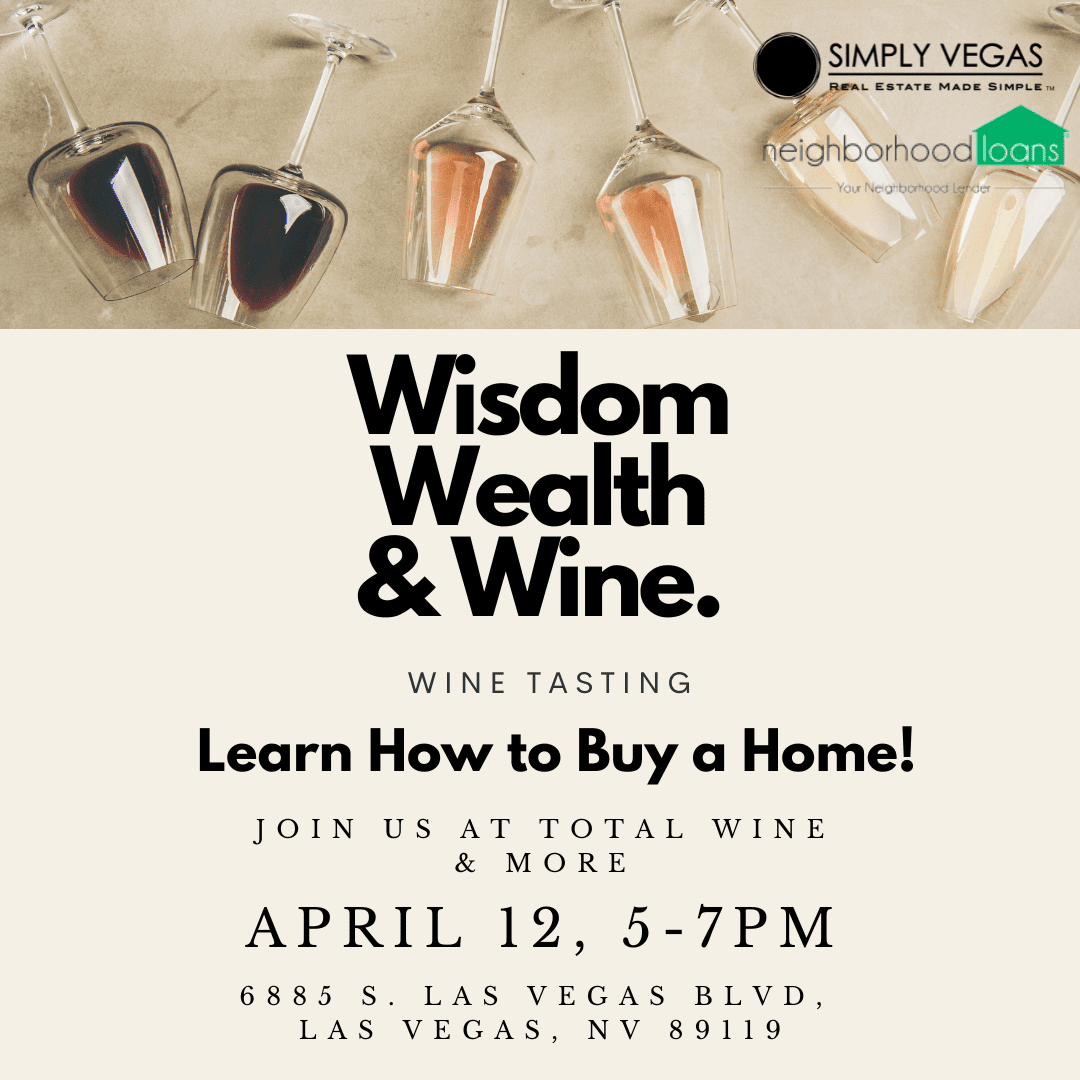

The event is called Wisdom-Wealth-Wine because we are going to share with you our wisdom of 18 years+ of experience and show you how to build wealth through owning real estate overtime and wine because we like to mingle and educate at the same time to make it a fun process.

Real estate is one of the most sound investments out there thanks to its steady appreciation rate and potential for income generation.

Lauren Paris, Chris Foxx and Angelina Casiello are excited to share their knowledge with you to help you make a good decision at this free educational home buyer event.

Homeownership can be an intimidating process, but it doesn’t have to be! With a few simple steps and some helpful tips, you can become a confident home buyer. Whether you’re buying your first home as an investment or for yourself, this event will help you make the best decisions for your future.

Steps of Buying A Home

Buying your first home is an exciting experience. However, there are several steps that need to be taken in order for you to get the keys to your new place.

Key factors that we will discuss-

Financing – Before anything else, it’s important to figure out how much house you can actually afford. This includes taking into account all relevant expenses such as taxes and insurance payments. Additionally, obtaining pre-approval from a lender or bank will give you access to more competitive interest rates and terms.

Research – Once financing has been figured out, it’s time to start researching potential homes in your area that fit into your desired budget range. This could include visiting open houses or browsing online listings from local real estate agents and brokers.

Make an Offer – After selecting the ideal property for purchase, make sure to craft a reasonable offer that takes into account current market conditions and any additional costs associated with closing on the house (such as appraisals or inspections).

Closing – The final step is closing on the property with all parties involved in attendance (buyer, seller, real estate agent/broker). This involves signing paperwork related to the sale and officially transferring ownership of the property over from one party to another.

Here are just a few of its many benefits of owning real estate-

• Financial Security – Real estate provides financial security by increasing net worth over time through monthly mortgage payments made towards principal reduction and built up equity over time; this also makes it easier for homeowners to qualify for future loans due to their improved credit score from consistently making payments on their mortgage loan(s).

• Tax Advantages – There are several tax deductions available for homeowners including those related to mortgage interest payments as well as major improvements made on their properties; these deductions can lead directly into significant savings come tax season every year!

• Long Term Appreciation – Real estate almost always increases in value over time due its limited supply nature; this ensures that homeowners can expect long-term gains upon selling their properties down the road if they so choose (often at much higher prices than what they originally paid!).

• Passive Income Generation – Owning rental properties allows investors/landlords an easy way of generating passive income without having too much direct involvement; this could include collecting rent payments each month or managing tenants while still receiving some sort of return on their initial investment(s).

• Equity Buildup – Homeowners can also build up equity each month through principal reduction when making their mortgage payments; this increases both wealth creation opportunities over time as well as added financial security should emergencies ever arise where cash needs quickly become available (such as medical bills or job loss scenarios).

• Family Legacy – Finally, owning real estate allows families to pass down generational wealth and legacy from one generation onto another; this could include passing down family homes between siblings/cousins or even gifting them outright upon death in order for future generations benefit from such investments!

• Hedge against inflation– When you buy a property with a fixed-rate mortgage you secure your housing payment, so it won’t go up like if you rent.

• Sense of accomplishment- buying a home is a major life milestone and accomplishment that is Empowering and gives a Pride of Ownership.

• Personalize your home into your ideal oasis with your own vision. Decorate, add backsplash, expand landscape.

• Escape the cycle of rising rent– Over the past several decades rent has gone up 40%

Purchasing your first home is an exciting journey! With proper planning and research beforehand, anyone can become successful when investing in real estate. Let’s make you a game plan!

We have limited seating for this Wisdom-Wealth-Wine event

Fill out the form below and let us know in the notes what your timeframe for buying is and you can register for this event and then we will send you the eventbrite link.

Have questions? Contact The Lauren Paris Group-702-768-8940