The Market’s Shifting—Is It Finally Time to Sell? Here’s What You Need to Know →

If you’ve been holding off on listing your home because you thought buyers weren’t out there—you’re not alone. Many homeowners have felt stuck, clinging to their historically low mortgage rates and unsure whether now is the right time to make a move.

Here’s the reality: the tide is turning.

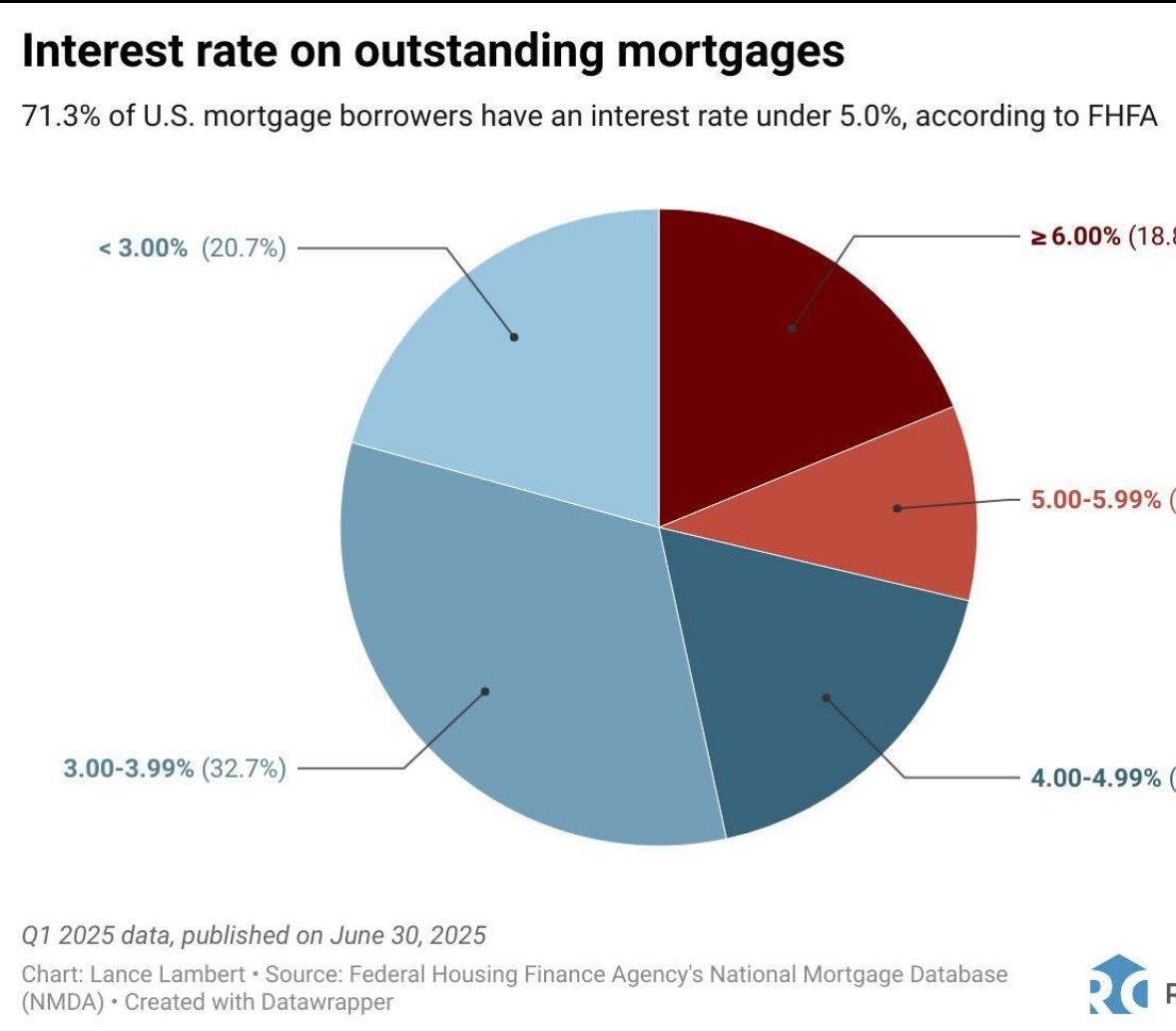

Over 20.7% of current mortgage holders are locked in under 3%, and 53.4% have a rate below 4%. That’s a huge portion of the market that’s been understandably hesitant to let go of such low monthly payments. But with shifting economic signals and renewed buyer activity, we’re seeing the early signs of movement—and opportunity.

What’s Changing?

Mortgage rates have been slowly edging down in recent months, fueled by cooling inflation, evolving Fed policy, and growing consumer confidence. And while the Fed doesn’t directly set mortgage rates, its actions (or even its tone) can move markets, and mortgage rates often follow.

Lower borrowing costs are breathing life back into buyer demand. According to the Mortgage Bankers Association, mortgage applications are trending upward, and we’re seeing more buyers re-enter the hunt after months on pause. As Lisa Sturtevant, Chief Economist at Bright MLS, puts it:

“A decrease in the cost of borrowing will boost homebuyer demand… Falling rates will also attract more sellers into the market.”

It’s already happening. The market is beginning to unlock.

Why This Matters If You’re a Homeowner

With more buyers stepping back in, sellers are regaining their edge. Rising demand can lead to:

-

Increased competition among buyers

-

Faster sales with fewer days on market

-

Stronger offers (often with fewer contingencies)

Pair that with today’s tight inventory, and your home stands out even more. Especially if you’ve owned your home for a decade or more, you’re likely sitting on significant equity, which you can now use to fund your next chapter, whether it’s upsizing, downsizing, or relocating entirely.

Don’t Wait for the Crowd

The best time to sell is often before everyone else does. With more homeowners still holding off due to “rate lock” hesitation, now could be your moment to stand out in a market that’s warming back up.

As Edward Seiler of the MBA explains:

“The slower pace of home-price appreciation, combined with lower rates, will alleviate affordability pressures and stimulate further activity in the housing market.”

Final Takeaway

We’re in a transitional market—but the direction is clear: falling rates are waking up buyers.

If you’re considering a move, don’t base your decision solely on where rates were—focus on where life is taking you next. I can help you evaluate your options, make a smart exit strategy, and position your home to shine in this evolving market.

Let’s chat and get your home sale-ready before the market gets crowded.