PSA

As a Las Vegas real estate expert who’s walked thousands of homeowners through every stage of the journey, I’ve learned that the little things — like tax notices — can sneak up and sting if you’re not prepared.

This time each year, I send out reminders to my past clients, but this year, I want to make sure everyone knows: check your property tax cap rate.

Why This Matters

If you own a home in Clark County, your property tax rate depends on whether the county knows it’s your primary residence. There are two possible tax cap rates:

-

3% Cap – For owner-occupied, primary residences

-

8% Cap – For second homes, rentals, or properties not listed as a primary residence

If you didn’t respond to a mailer from the county last year confirming your property’s occupancy status, your tax cap rate may have automatically bumped up to 8% — even if you do live in the home full-time. That means you’re potentially paying thousands more than necessary.

What to Look For

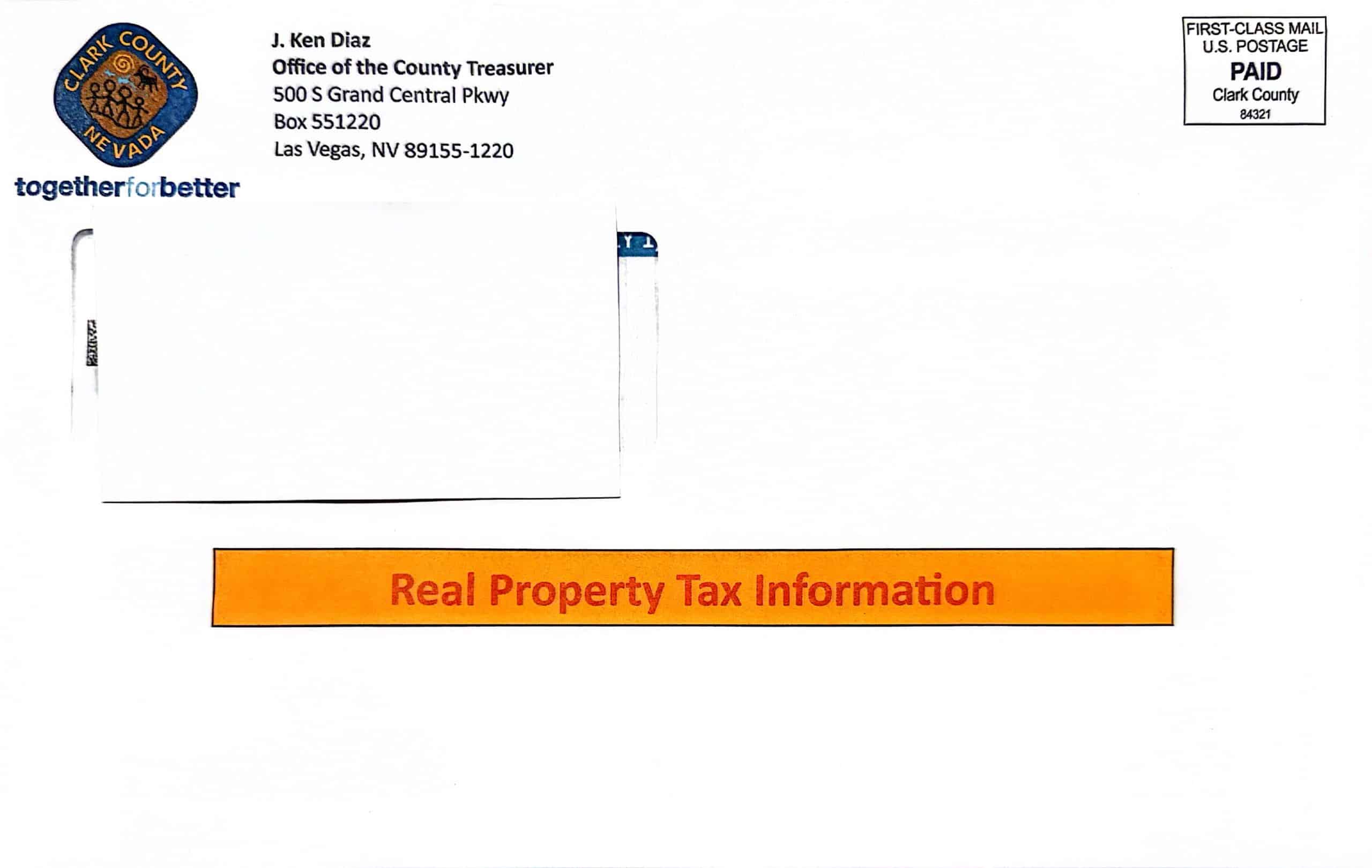

You should receive a postcard or letter from the Clark County Assessor’s Office asking you to confirm the occupancy of your property. It’s short, easy to miss, and often ends up buried in junk mail — but it’s incredibly important.

← The letter looks like this.

At the bottom, it will list your current Tax Cap Rate and Cap Type.

-

If it says Cap Type: Other and Tax Cap: 8%, and the home is your primary residence, you need to take action.

Lauren Paris is your real estate resource for life!

Contact the Lauren Paris Group today & discover what we can do for you.