Why So Many Are Calling Nevada Home – The Tax Benefits of Living in the Silver State

By Lauren Paris, Your Local Relocation Expert

If you’re considering relocating, there’s a reason so many families and business owners are making Nevada their new home. From no personal state income tax to a business-friendly climate, Nevada offers a long list of financial and lifestyle advantages that make it one of the most desirable places to live — especially for those looking to maximize their earnings and minimize their tax burdens.

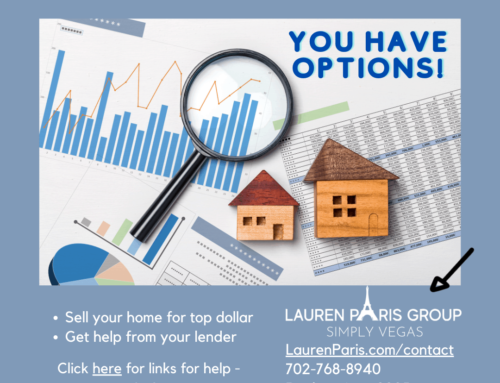

- No State Income Tax

One of the biggest reasons new residents are flocking to Nevada? There is no personal state income tax. That means more of your hard-earned money stays in your pocket. Whether you’re a salaried employee, entrepreneur, or retiree drawing income from investments, living in Nevada can offer significant tax savings compared to states like California or New York.

Primary Residency Matters

To enjoy these tax benefits, Nevada must be your primary residence. That means it’s the state you’re most closely connected to — where you vote, register your vehicles, and spend the majority of your time. You can still own property and conduct business in other states, but Nevada should be your home base.

Even if you earn income from other states, Nevada residency can still reduce your overall state tax liability. In many cases, only income specifically sourced to a state that does tax income will be subject to those taxes — the rest may remain tax-free at the state level.

Incredible Benefits for Business Owners. Nevada is known as one of the most pro-business states in the country, with many advantages for entrepreneurs, startups, and small business owners:

-

No corporate income tax

-

No franchise tax

-

No gross receipts tax

-

No inventory tax

-

No tax on the issuance or transfer of corporate shares

-

No personal income tax on business profits

-

No requirements for directors or shareholders to be Nevada residents

-

No succession or inheritance tax at the state level

Plus, Nevada does not share your financial information with the IRS, adding an extra layer of privacy for individuals and companies alike.

- Low Property Taxes

Another major financial perk of living in Nevada is our low property tax rate, which consistently ranks below the national average. Homeowners can enjoy luxury living with more square footage and amenities — all while paying less in annual taxes than they might in other states.

Simple & Private Business Structures Nevada offers:

-

Anonymity for business owners (protecting privacy)

-

Protection for corporate officers and directors

-

No minimum capital requirements

-

Simple annual reporting requirements

Whether you’re forming a new LLC or incorporating a business, Nevada makes the process straightforward and secure.

Why Families Are Choosing Nevada

From no income tax to affordable homeownership, sunny weather, and endless entertainment, Nevada offers a unique blend of opportunity and lifestyle. It’s no surprise that so many visitors become locals — and once you discover the benefits, you may not want to leave either!

If you’re considering making Nevada your home, let’s talk! I’ve helped countless families and business owners successfully relocate to the Las Vegas and Henderson areas, and I’d love to help guide your move.

Lauren Paris

Your Trusted Las Vegas & Henderson Relocation Expert

702-768-8940 | LP@LaurenParis.com

Your Trusted Las Vegas & Henderson Relocation Expert

702-768-8940 | LP@LaurenParis.com