Two Things That Can Make Selling Complicated…

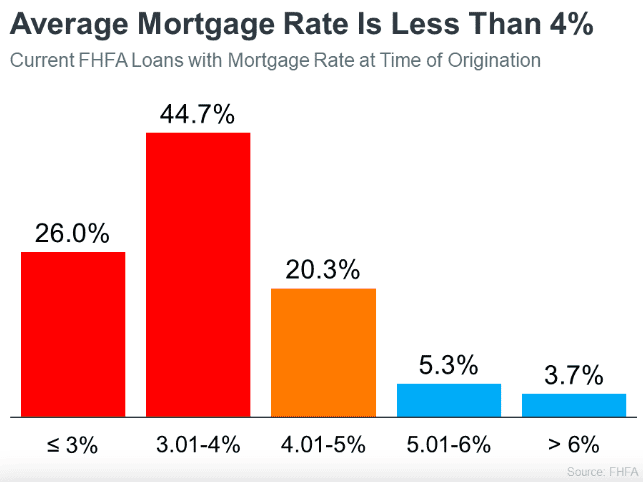

Numerous homeowners contemplating selling their homes face two significant obstacles. Firstly, they may feel constrained by the prevailing higher mortgage rates, making them hesitant to proceed. Secondly, there’s the worry that they might struggle to find a suitable property to buy due to the scarcity of available options in the market. Let’s explore each of these challenges and provide valuable advice to help overcome them.

Advice:

Despite experts’ projections of a gradual decline in mortgage rates this year due to cooling inflation, waiting to sell may not be the wisest choice. Predicting mortgage rates accurately is notoriously difficult. Moreover, the current trend shows an upswing in home prices. By making your move now, you can stand out of crowd while we are low on inventory and avoid the risk of rising home prices when purchasing your next property. Even if the anticipated rate decrease occurs, you have the option to refinance later if such an opportunity arises. I always negotiate with the seller’s agent to pay towards my buyer’s closing costs to buy down rate here.

Advice:

If the fear of not finding your next home is the main factor holding you back, keep in mind that exploring all available options is crucial. Broadening your search to include various housing types like condos, townhouses, and newly built homes can provide you with a wider range of choices. Moreover, if your work situation allows for full remote or hybrid arrangements, you can consider areas that were not previously on your radar. By expanding your search radius and considering locations farther from your workplace, you might discover more affordable and suitable options for your next home.

Contact Lauren

Another positive is that when a seller contributes to buyer’s closing costs to buy the rate down, this is a write off for the seller on taxes since they paid “points”.

Another positive is that when a seller contributes to buyer’s closing costs to buy the rate down, this is a write off for the seller on taxes since they paid “points”.